Venture Capital Investment Decision Making Process Deal Structuring And Closing

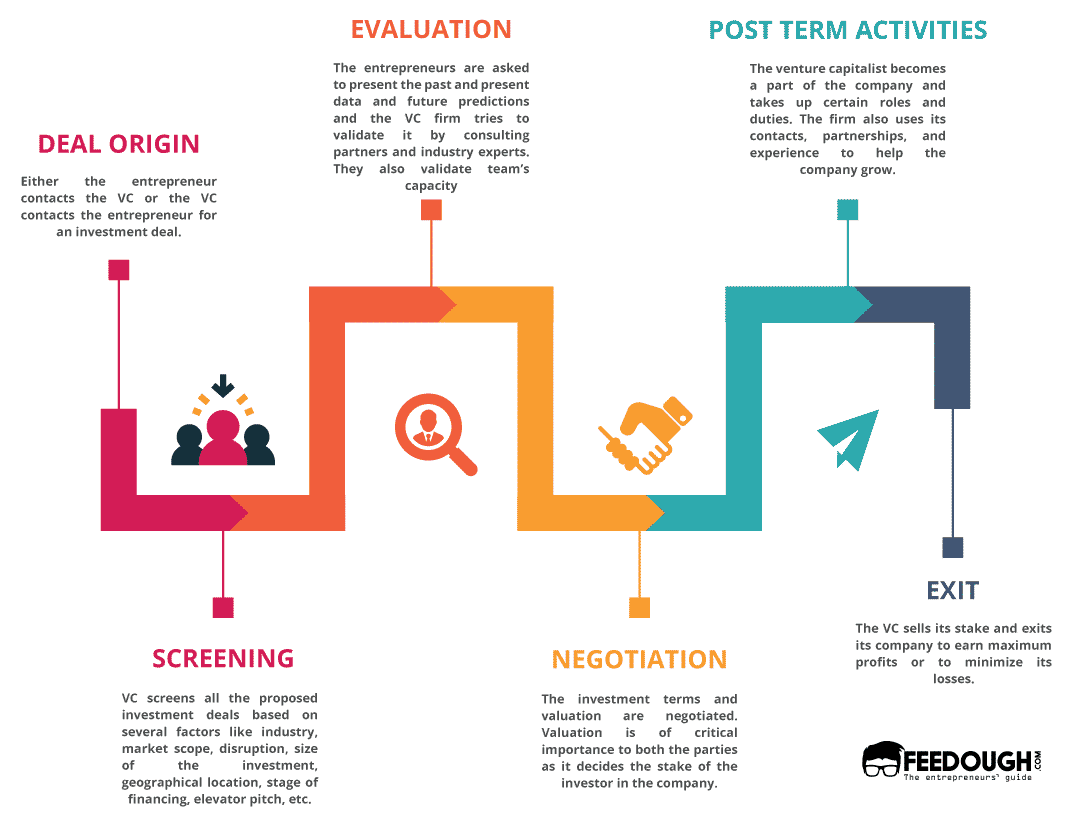

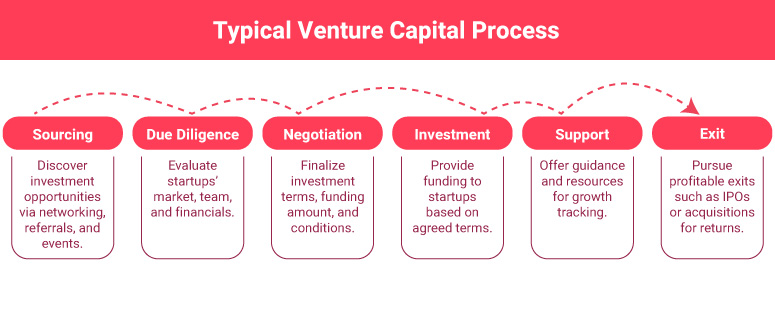

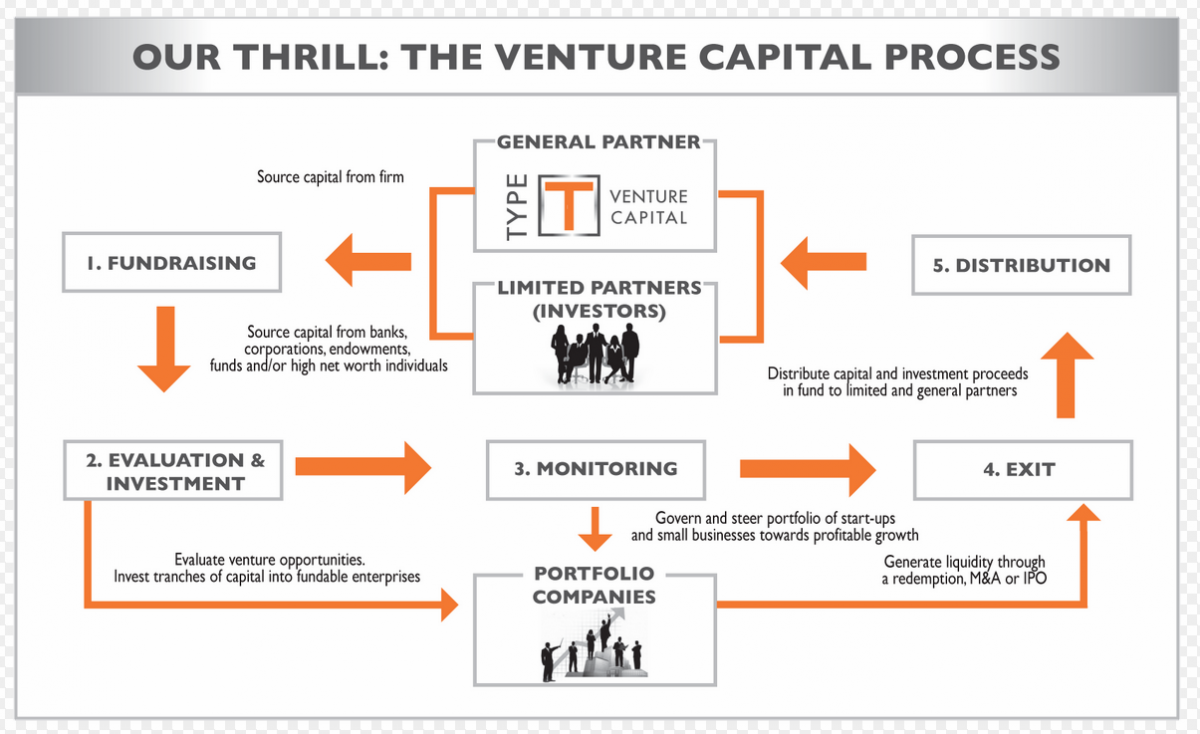

Venture Capital Investment Decision Making Process Deal Structuring And Closing Youtube This exploratory study examines the deal structuring stage of the venture capitalist decision‐making process. here, the primary issues of concern are investor confidence and potential control of a venture in relation to the level of financing the investor provides and the structure with which the funding is delivered. Involves decision making by various participants in the venture capital investment process (i.e., investment committees, supervi sory boards, managing directors, investment officers). all chan nels are interrelated and required for the successful completion of a venture capital deal. the model of the venture capital process.

What Is Venture Capital How It Works Venture capital investment decision making process. it identifies generic criteria that venture capitalists use. a six stage process model is proposed: origination, venture capital firm specific screen, generic screen, first phase evaluation, second phase evaluation, and closing. different activities occur in each stage. it is argued that the. For decades now, venture capitalists have played a crucial role in the economy by financing high growth start ups. while the companies they’ve backed—amazon, apple, facebook, google, and more. We survey 885 institutional venture capitalists (vcs) at 681 firms to learn how they make decisions. using the framework in kaplan and strömberg (2001), we provide detailed information on vcs’ practices in pre investment screening (sourcing evaluating and selecting investments), in structuring investments, and in post investment monitoring. Stage firms. consequently, venture capital is often regarded as a subset of private equity. to simplify matters, this book uses the term “ven ture capital” as its primary description of investing into private firms. the completion of a successful venture capital or private equity deal requires the deal to progress through a multistage process.

How To Get Venture Capital Funding In 10 Steps Truic We survey 885 institutional venture capitalists (vcs) at 681 firms to learn how they make decisions. using the framework in kaplan and strömberg (2001), we provide detailed information on vcs’ practices in pre investment screening (sourcing evaluating and selecting investments), in structuring investments, and in post investment monitoring. Stage firms. consequently, venture capital is often regarded as a subset of private equity. to simplify matters, this book uses the term “ven ture capital” as its primary description of investing into private firms. the completion of a successful venture capital or private equity deal requires the deal to progress through a multistage process. The main objective of this chapter is to describe the key elements of the venture capital investment process and the challenges that impact each of its stages post covid response, beginning with deal generation. table 5.1 describes the details of the key changes in each stage of the venture capital investment process post covid response. A comprehensive research on making investment decisions in financing venture projects was conducted, and a survey of 31 investors in venture projects, including the issues of deal structuring in.

Understand Venture Capital With 12 Necessary Infographics The main objective of this chapter is to describe the key elements of the venture capital investment process and the challenges that impact each of its stages post covid response, beginning with deal generation. table 5.1 describes the details of the key changes in each stage of the venture capital investment process post covid response. A comprehensive research on making investment decisions in financing venture projects was conducted, and a survey of 31 investors in venture projects, including the issues of deal structuring in.

Stages Of Venture Capital Silicon Valley Bank

Comments are closed.