Venture Capital Deal Structures Complete Guide 2023

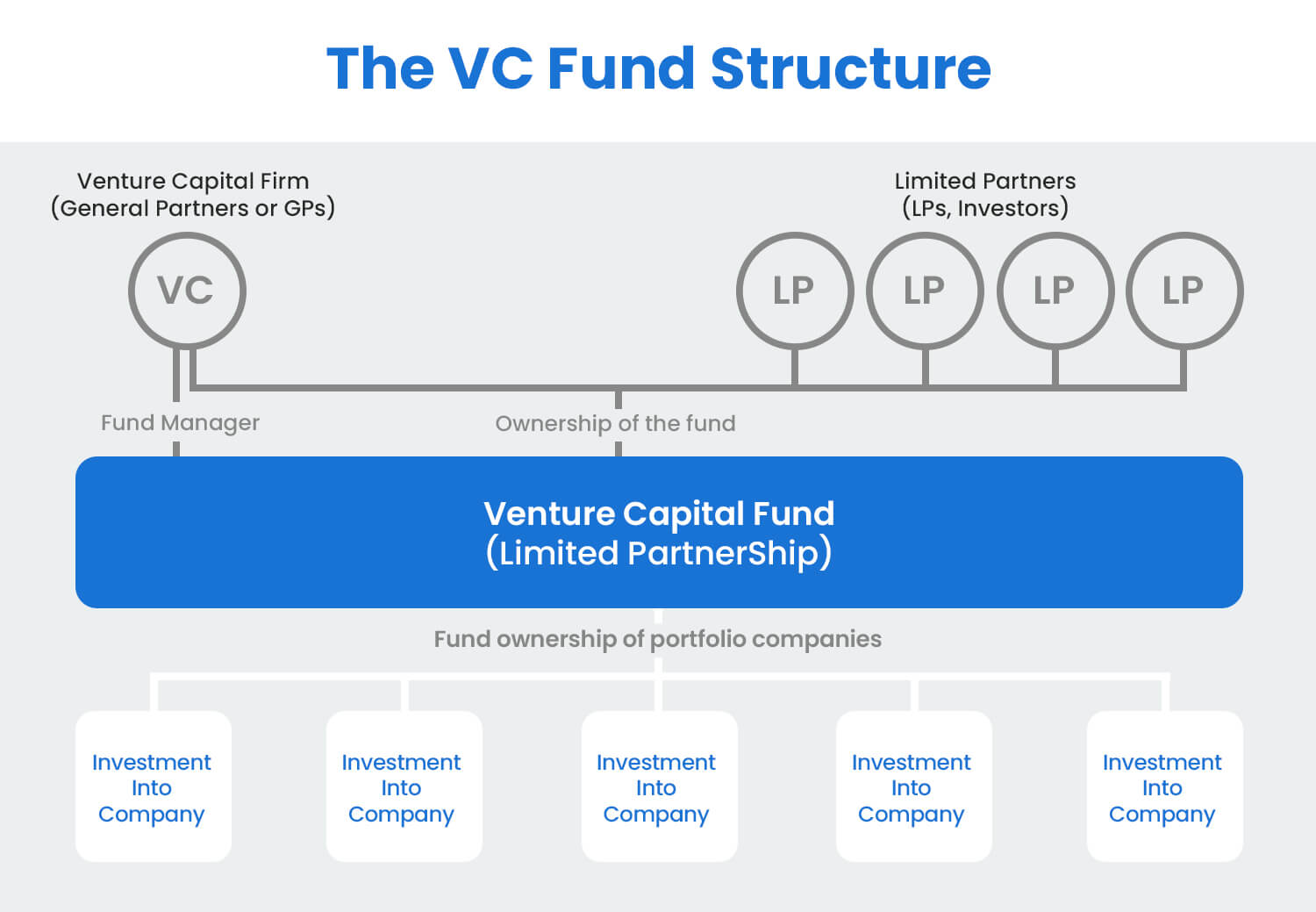

Venture Capital Deal Structures Complete Guide 2023 Venture capital deal structure & terms: complete guide (2024) during 2022, global venture capital deals crossed the $225 billion barrier and are on track to beat the 2021 record of $330 billion. the overall venture capital dollar volume is also growing. the growth of venture capital deals would be remarkable in 'normal’ times. A typical deal structure goes something like the following: 1. a venture capital (vc) fund invests $5 million in exchange for 30% of preferred equity. the fact that this is preferred equity is.

Venture Capital Deal Structures Complete Guide 2023 Seed deal activity slowed slightly. in q3 of 2023, $4.3b was invested across 1,083 deals, compared to $6.4b and 1,572 deals in q3 of 2022. however, median seed round sizes slightly increased from. Vc term sheet definition. the vc term sheet is a non binding legal document that forms the basis of more enduring and legally binding documents, such as the stock purchase agreement and voting agreement. although short lived, the vc term sheet’s main purpose is to lay out the initial specifics of a vc investment such as the valuation, dollar. The data is also consistent with the financings reported in the u.s. deal studies in 2023, including fenwick’s silicon valley venture capital survey — third quarter 2023 [pdf] and wilson sonsini’s the entrepreneurs report private company financing trends [pdf], where between 3% and 7% of such u.s. financings included a redemption right. Below is the firm's deal flow process, which is representative of the workflow most vc firms follow: . stage 1: deal sourcing the first stage in the deal flow process is broadly referred to as deal sourcing or deal origination in venture capital. this is the process of finding appropriate leads and bringing them to your company's attention.

Comments are closed.