Stages Of Venture Capital Silicon Valley Bank

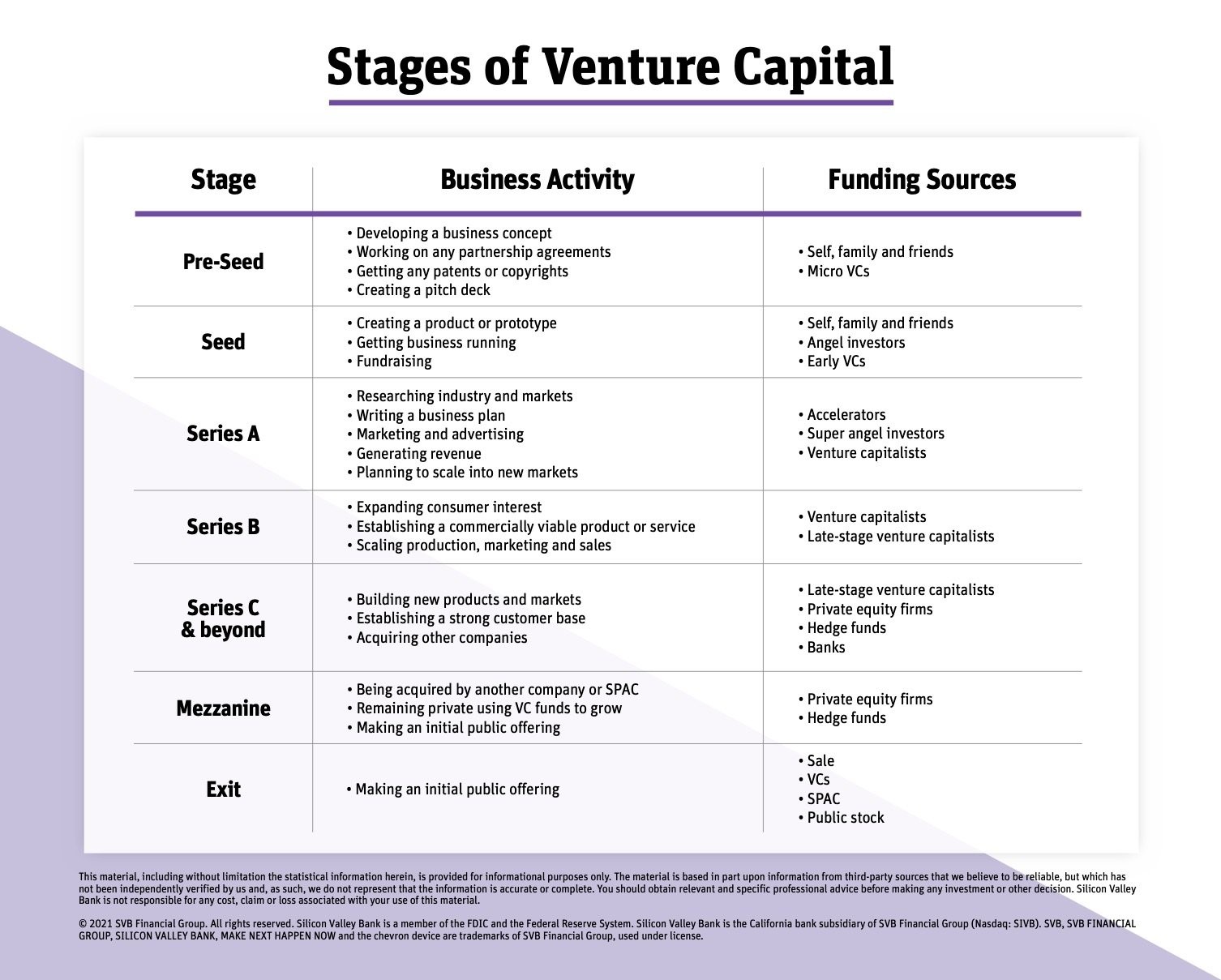

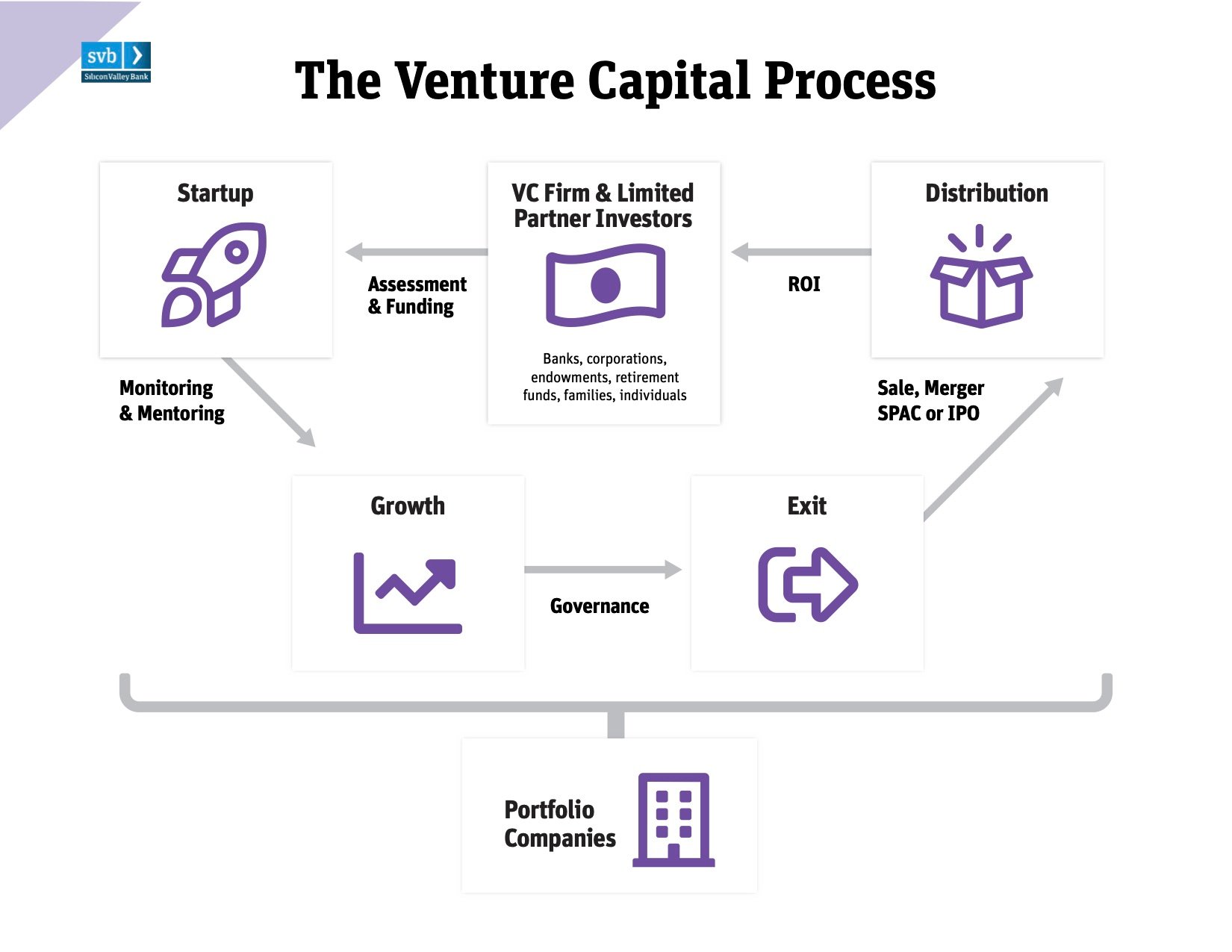

Stages Of Venture Capital Silicon Valley Bank Venture capital (vc) helps make it possible for promising entrepreneurs, some with little or no operating history, to secure capital and launch their businesses. the financing pattern of venture capital typically follows through a series of funding rounds starting from pre seed, seed, series a, b, c, and sometimes d rounds, each stage representing a different level of company maturity and. Venture capital definition. venture capital (vc) is generally used to support startups and other businesses with the potential for substantial and rapid growth. vc firms raise money from limited partners (lps) to invest in promising startups or even larger venture funds. for example, when investing in a startup, vc funding is provided in.

What Is Venture Capital Silicon Valley Bank Silicon valley bank knows the innovation economy like no other bank. for 40 years, we've partnered with founders who are inventing the future. read the state of u.s. early stage venture and startups report for data, trends and insight into the unique and fluid world of early stage startups and venture capital. Now, recall, another bank called silvergate had just collapsed (for crypto reasons). investors, like horses, are easily spooked. so when silicon valley bank made this announcement on march 8th. Notable portfolio companies: airbnb, peloton, draftkings, zendesk, pandora. notable capital is a venture capital firm with a 20 year history of partnering with visionary founders. with $4.2 billion in assets under management, the firm has invested in over 200 companies and supported 30 ipos. Seed and early stage companies have seen the largest drop in venture debt deal volume. that’s in contrast with equity vc deals: earlier stages held up better than later stages last year. pitchbook recorded 665 early stage venture debt deals in 2022. by the end of 2023, the equivalent figure had dropped to 408 deals, a 39% decline.

Comments are closed.