Scusa Reaches 550m Settlement With 33 States Over Subprime Paper Auto Remark

Scusa Reaches Record 9 35m Settlement With Doj Over Repossessions Auto Santander consumer usa, the largest subprime car lender in the us, has agreed a $550m settlement to resolve claims of deceptive lending. practices brought by a coalition of state authorities. the. Santander consumer reaches $550m settlement with state ags. santander consumer usa will pay $65 million to states and forgive hundreds of millions more in consumer debt as part of a settlement with a group of attorneys general over practices in its subprime auto lending business. the attorneys general, representing 33 states and the district of.

Scusa Reaches 550m Settlement With 33 States Over Subpr Scusa reaches $550m settlement with 33 states over subprime paper wednesday, may. 20, 2020, 03:29 pm. subprime auto finance news staff officials said scusa has also agreed to injunctive. Published 3:01 pm pdt, may 19, 2020. sacramento, calif. (ap) — thirty four attorneys general announced a $550 million settlement tuesday with auto loan financing company santander over allegations it knowingly targeted consumers who were likely to default on its loans. consumers who defaulted on their loans from the company as of last year. Santander consumer usa, the consumer lending arm of spain’s banco santander, reached a $550 million agreement to settle charges from 34 attorneys general that it made auto loans it knew low income and subprime borrowers could not pay. the lender is set to pay consumers $65 million in restitution. but the bulk of the settlement — $478. According to the santander car loan website, the $65 million settlement will be used for subprime consumers who have defaulted on loans between jan. 1, 2010 and dec. 31, 2019. santander is required to allow customers to keep their car and waive any loan balance for those who have the lowest quality loans and have defaulted as of dec. 31, 2019.

Ppt Banks Subprime Crisis Powerpoint Presentation Free Download Id 1544301 Santander consumer usa, the consumer lending arm of spain’s banco santander, reached a $550 million agreement to settle charges from 34 attorneys general that it made auto loans it knew low income and subprime borrowers could not pay. the lender is set to pay consumers $65 million in restitution. but the bulk of the settlement — $478. According to the santander car loan website, the $65 million settlement will be used for subprime consumers who have defaulted on loans between jan. 1, 2010 and dec. 31, 2019. santander is required to allow customers to keep their car and waive any loan balance for those who have the lowest quality loans and have defaulted as of dec. 31, 2019. Santander consumer usa holdings inc said tuesday it has agreed to a settlement with 33 states and the district of columbia worth $550 million over subprime auto loans and to make changes to. Bloomberg. washington santander consumer usa holdings inc. said on tuesday it had agreed to make changes to its underwriting practices as part of a $550 million settlement with 33 states and.

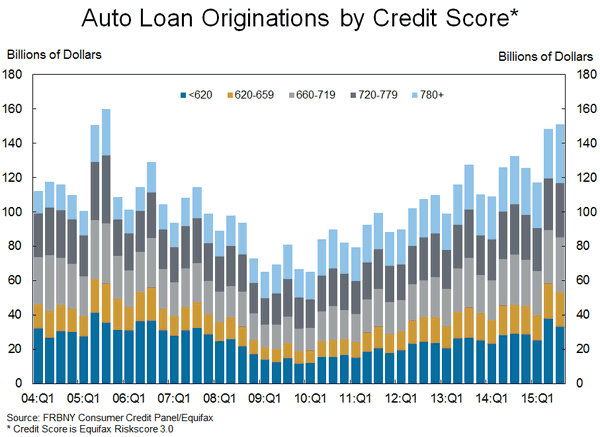

Subprime Debt Makes A Comeback Auto Loan Crisis Is Here The Market Oracle Santander consumer usa holdings inc said tuesday it has agreed to a settlement with 33 states and the district of columbia worth $550 million over subprime auto loans and to make changes to. Bloomberg. washington santander consumer usa holdings inc. said on tuesday it had agreed to make changes to its underwriting practices as part of a $550 million settlement with 33 states and.

Westlake Part Of Third Doj Settlement In 13 Months Over Scra Violations Auto Remar

Comments are closed.