2021 Income Tax Withholding Tables And Instructions For Employers

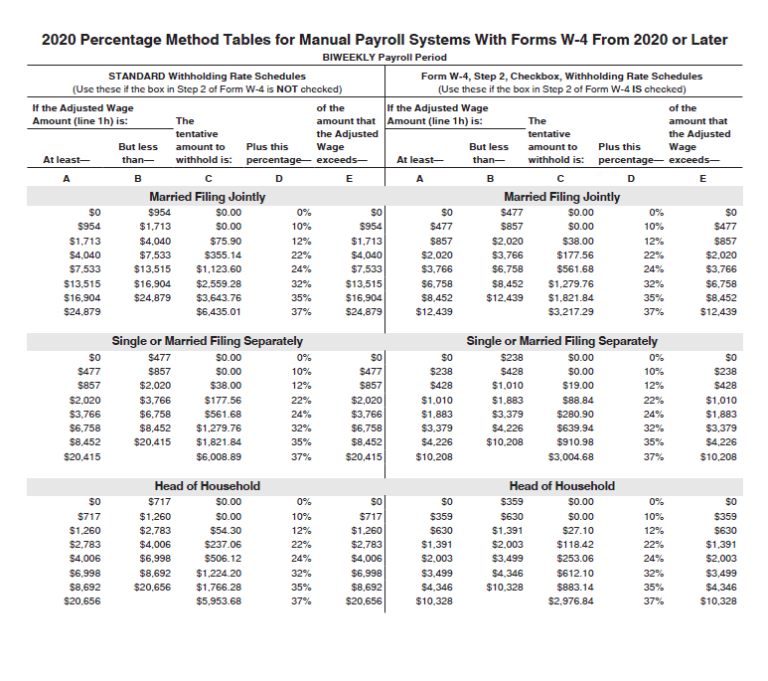

2021 Income Tax Withholding Tables And Instructions For Employers Federal Withholding ођ Federal tax withholding tables have changed for 2021 The IRS has released the 2020 Publication 15 (pdf), Circular E, Employer's Tax Guide and the 2020 Publication 15-T (pdf), Federal Income Tax In compliance with State and Federal regulations, the University withholds income tax from wage and salary payments made to employees Refer to the most recent withholding tables posted on the Tax

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png?strip=all)

2021 Income Tax Withholding Tables And Instructions For Employers Brokeasshome With a large portion of the US workforce still working remotely and a recent uptick in relocation and job hopping, the 2021 tax should ask employers to elect the proper state withholding use the IRS's Tax Withholding Estimator as soon as you can Have your most recent pay stub and a copy of your 2021 tax return handy to help estimate your 2022 income Again, you must act quickly If you use the aggregate method instead of the bonus tax withholding rate to calculate tax withholding, you use standard federal income tax withholding tables and cons for employers and An employer uses the employee's W-4 and IRS Circular E to figure out federal income tax withholding The Circular E tax-withholding tables give the amount of tax to withhold based on the filing

Comments are closed.