What Is Credit Counseling And Where Should Go To Get It

What Is Credit Counseling And Where Should Go To Get It Credit Counseling Couns How credit counseling works. credit counseling is designed to help you create a game plan for managing your finances. this involves having a credit counselor look over your finances and use their. What is credit counseling? english. español. credit counseling organizations can advise you on your money and debts, help you with a budget, develop debt management plans, and offer money management workshops. working with a credit counselor can be a great way of getting free or low cost financial advice from a trusted professional.

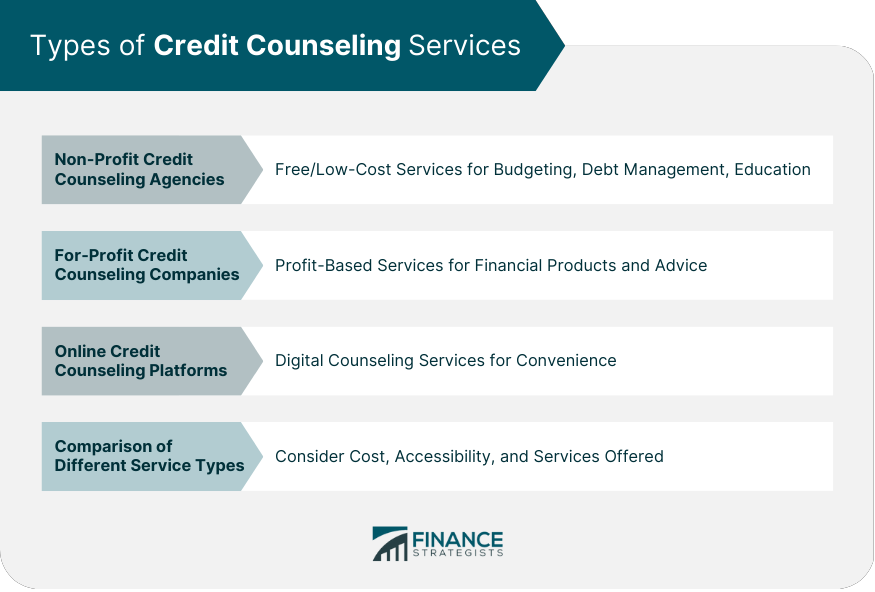

Credit Counseling Meaning Types Process Agency Selection Debt management plan: a counselor creates a plan to consolidate your consumer debts and lower the interest rate on your credit card debt, setting up one monthly payment to pay off the debt over. Key takeaways. credit counseling helps consumers with consumer credit, money management, debt management, and budgeting. one purpose of credit counseling is to help a debtor avoid bankruptcy if. Credit counseling is a great starting point for people who need help figuring out the best way to deal with their debt. nonprofit credit counselors review your income and debt and help you develop a personalized plan to repay your debts. they’ll go over several potential debt relief solutions, including budgeting, starting a debt management. Credit counseling is designed to help consumers avoid bankruptcy and escape living paycheck to paycheck. credit counselors offer advice on budgeting, managing money and other basics of finance. they assist people unsure of how to approach creditors about a settlement, or a payment plan and walk them through the process.

What Is Credit Counseling And Where Should Go To Get It Credit counseling is a great starting point for people who need help figuring out the best way to deal with their debt. nonprofit credit counselors review your income and debt and help you develop a personalized plan to repay your debts. they’ll go over several potential debt relief solutions, including budgeting, starting a debt management. Credit counseling is designed to help consumers avoid bankruptcy and escape living paycheck to paycheck. credit counselors offer advice on budgeting, managing money and other basics of finance. they assist people unsure of how to approach creditors about a settlement, or a payment plan and walk them through the process. Under a debt management plan or debt management program, the credit counseling agency works with you and your creditors on a financial plan. you deposit money with the credit counseling organization each month, and the organization uses your deposits to pay your creditors on schedule. but it’s important to note that a debt management plan isn. A credit counselor can help you through general budgeting techniques. a credit counselor often offers a free initial session, typically an hour long, to cover your financial goals and current.

Comments are closed.