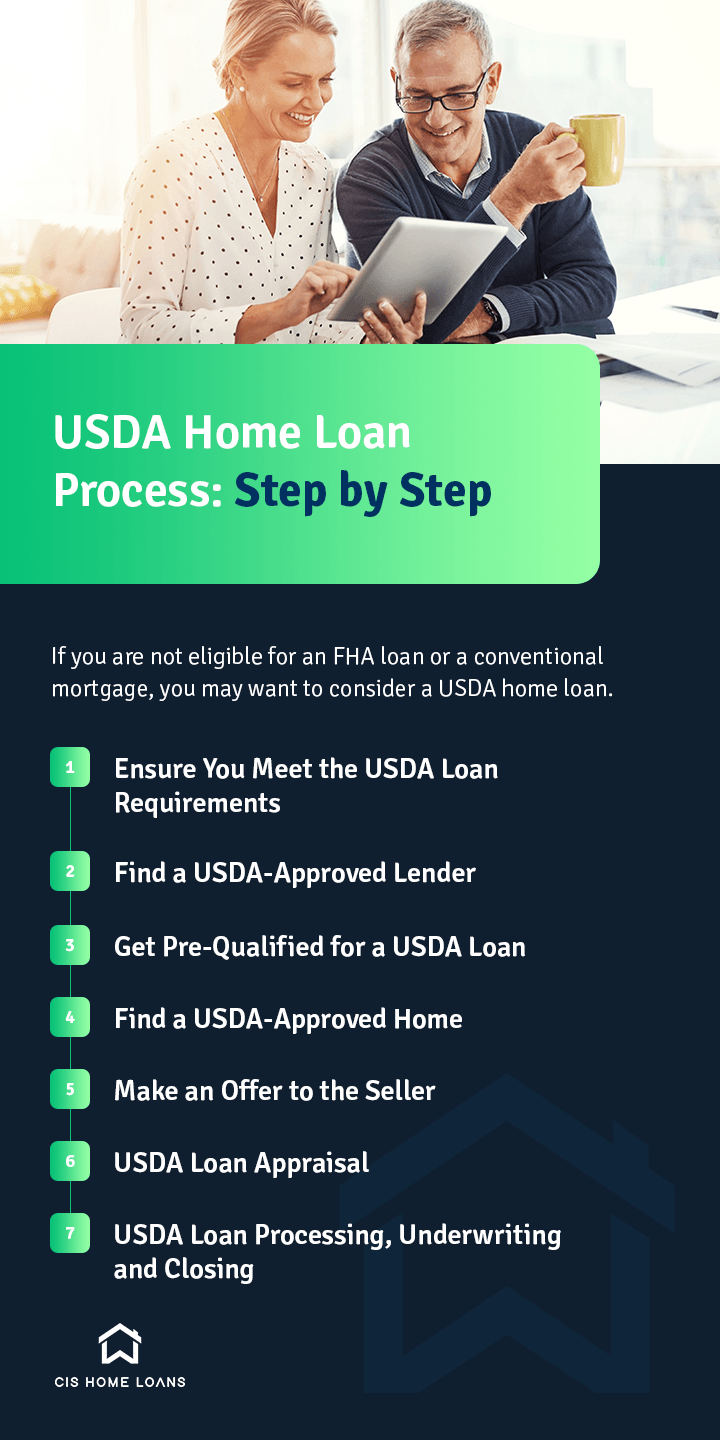

Usda Home Loan Process Step By Step Cis Home Loans

Usda Home Loan Process Step By Step Cis Home Loans 1. ensure you meet the usda loan requirements. the first step of the usda loan process is to ensure you meet the requirements. before you complete the usda loan application process, you will want to consider several things, including location, income, credit score and residency. to be eligible for a usda construction loan or home loan, you must. The step by step process for applying for a usda loan involves prequalification, preapproval, finding a home in an eligible area, making an offer, loan underwriting, and finally closing.

Usda Home Loan Process Step By Step Cis Home Loans Uac Blog Boydton, va 23917. view. $459,000. 3 bed 3 bath 1,908 sqft. 291 eastland creek rd. boydton, va 23917. view. all in all, in the best case circumstances, you can expect the usda home loan process to. 2. choose an fha approved lender. the next part of the fha loan process is finding an fha approved lender. despite popular misconception, fha loans are not made by the government. instead, they are originated by private lenders and insured by the government. Days 2 6: initial processing of application – credit conditions. once you submit all necessary personal and financial information—pay stubs, bank statements, tax returns, driver’s license, social security cards, etc.—a cis loan officer collects up front verifications. keep in mind that the more complicated the file, the longer the. W 2s from the last two years. 30 days of pay stubs. 1099s (if you are self employed or an independent contractor) driver’s license or some other form of government issued photo identification.

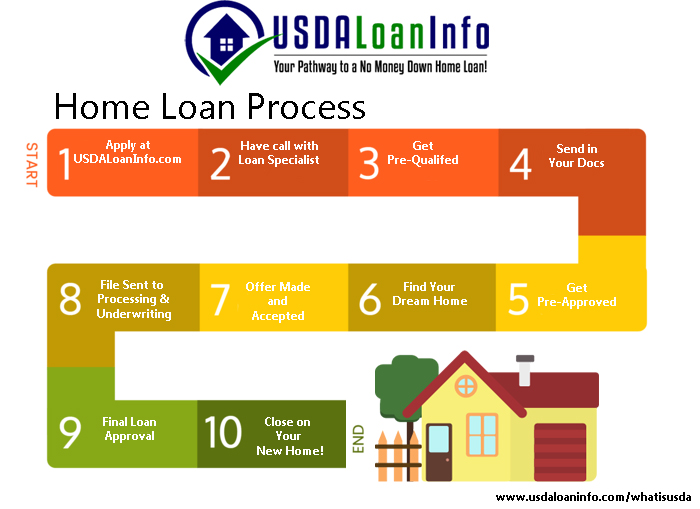

Usda Home Loan Process Step By Step Cis Home Loans Days 2 6: initial processing of application – credit conditions. once you submit all necessary personal and financial information—pay stubs, bank statements, tax returns, driver’s license, social security cards, etc.—a cis loan officer collects up front verifications. keep in mind that the more complicated the file, the longer the. W 2s from the last two years. 30 days of pay stubs. 1099s (if you are self employed or an independent contractor) driver’s license or some other form of government issued photo identification. The usda mortgage process. generally speaking, the usda home loan process follows the same basic procedure as other types of home loans. (you can find a general overview of the mortgage process here, for reference.) here’s what to expect from a usda specific mortgage process: 1. achieve prequalification and preapproval for a usda loan with a. Private lenders, including banks, mortgage lenders, and credit unions, are authorized to offer usda loans. the application process is similar to other home loans: compare rates, choose a lender.

Usda Home Loan Process Are You Applying For A Usda Home Loanо The usda mortgage process. generally speaking, the usda home loan process follows the same basic procedure as other types of home loans. (you can find a general overview of the mortgage process here, for reference.) here’s what to expect from a usda specific mortgage process: 1. achieve prequalification and preapproval for a usda loan with a. Private lenders, including banks, mortgage lenders, and credit unions, are authorized to offer usda loans. the application process is similar to other home loans: compare rates, choose a lender.

Comments are closed.