Understanding Your Credit Report

How To Read And Understand Your Credit Report Cathay Bank Learn how to interpret the sections and details of your credit report, such as personal information, public records, account information, and more. see examples of credit report entries and tips to help you understand your credit score. You can request your credit report in spanish directly from each of the three major credit bureaus: · transunion: call 800 916 8800. · equifax: visit the link or call 888 378 4329. · experian.

Understanding Credit Scores Some financial advisors suggest staggering your requests over a 12 month period to help keep an eye on your reports and make sure they have accurate information. the best way to get your free credit report is to. go to annualcreditreport or. call annual credit report at 1 877 322 8228. Understanding your credit report can guide your spending and borrowing choices, leading to a better credit score. regular scrutiny of your credit report is essential to identify any inaccuracies. 1. personal information. identity information on your reports may include your …. name. social security number. date of birth. address. phone number. if you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. Understanding your experian credit report. your experian credit report contains information about you and your account history with credit cards and loans. the main sections in your experian credit report are personal information, accounts, collections, credit inquiries and public records.

A Beginner S Guide To Understanding Your Credit Report Ez Home Search 1. personal information. identity information on your reports may include your …. name. social security number. date of birth. address. phone number. if you find incorrect identity information on one of your credit reports, you can file a dispute or an update with the reporting credit bureau to change it. Understanding your experian credit report. your experian credit report contains information about you and your account history with credit cards and loans. the main sections in your experian credit report are personal information, accounts, collections, credit inquiries and public records. Learn how to read and review your credit report, what it means, and how it affects your credit situation. find out how to dispute errors, check your credit score, and get tips to improve your credit. There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of.

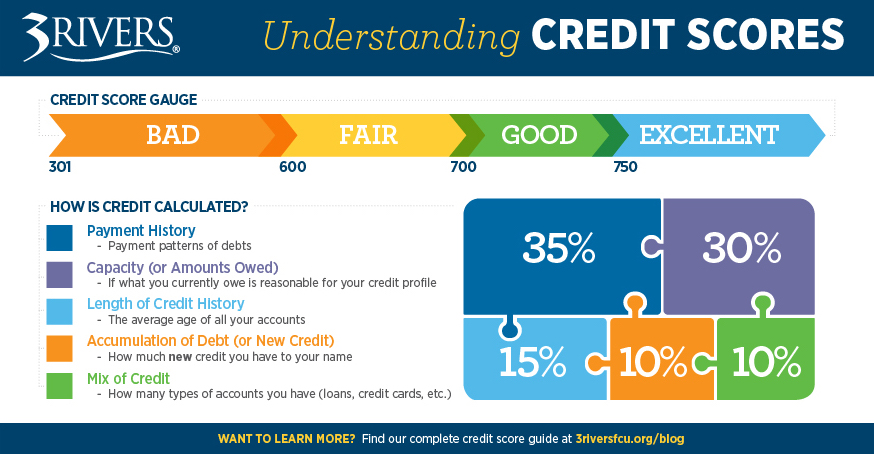

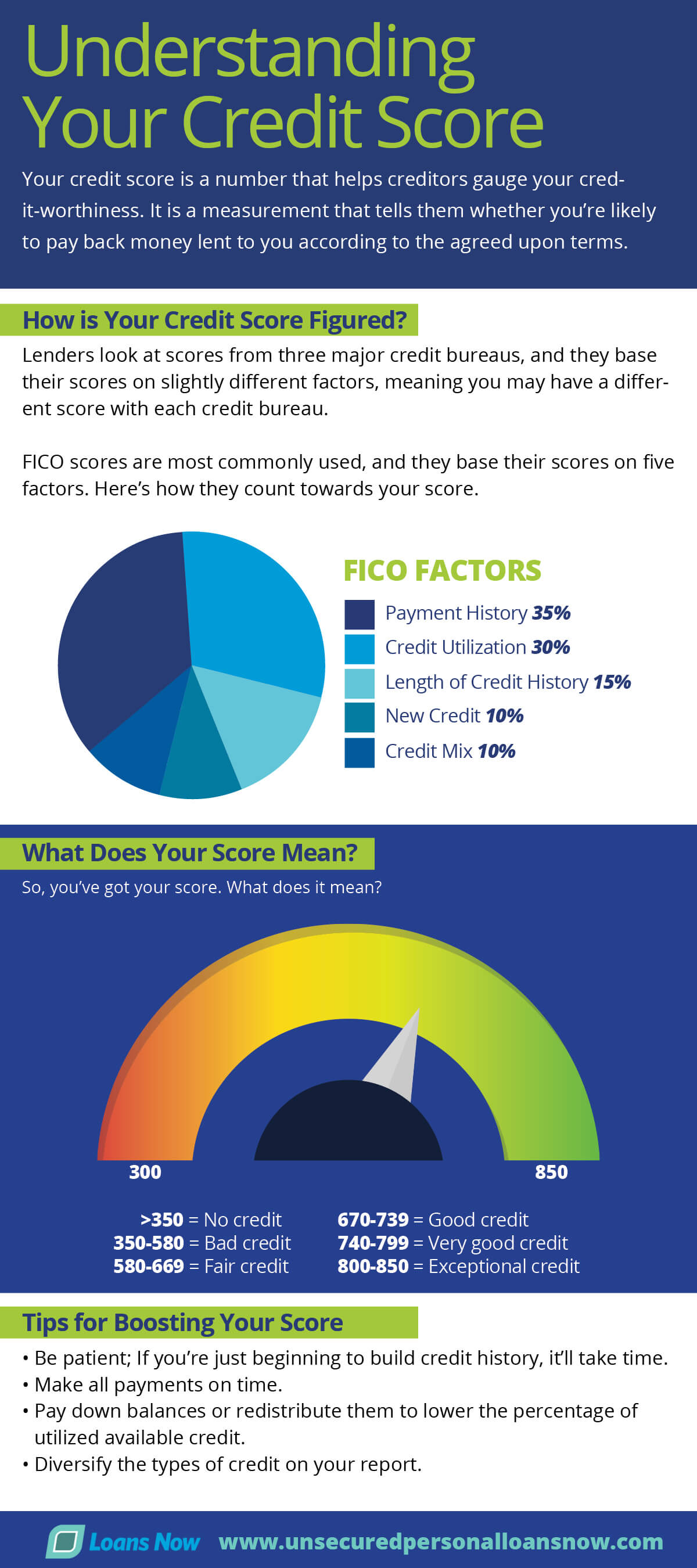

Understanding Your Credit Score Learn how to read and review your credit report, what it means, and how it affects your credit situation. find out how to dispute errors, check your credit score, and get tips to improve your credit. There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of.

Comments are closed.