Mortgage Calculators Lendingtree

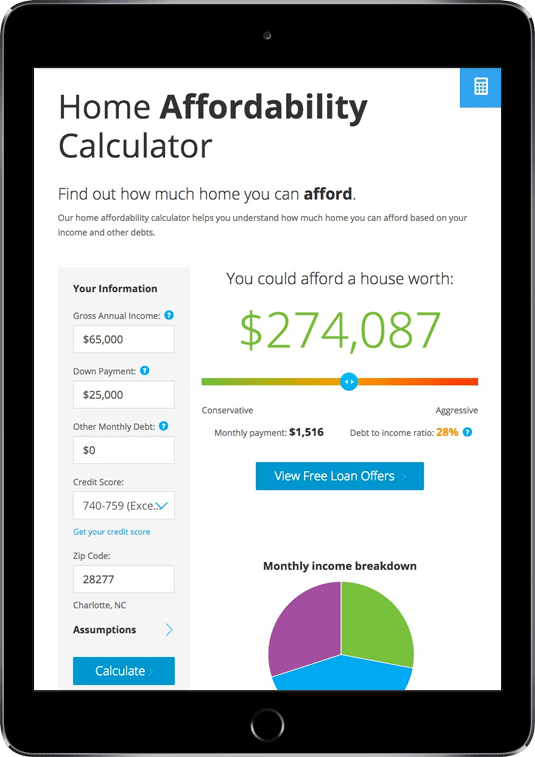

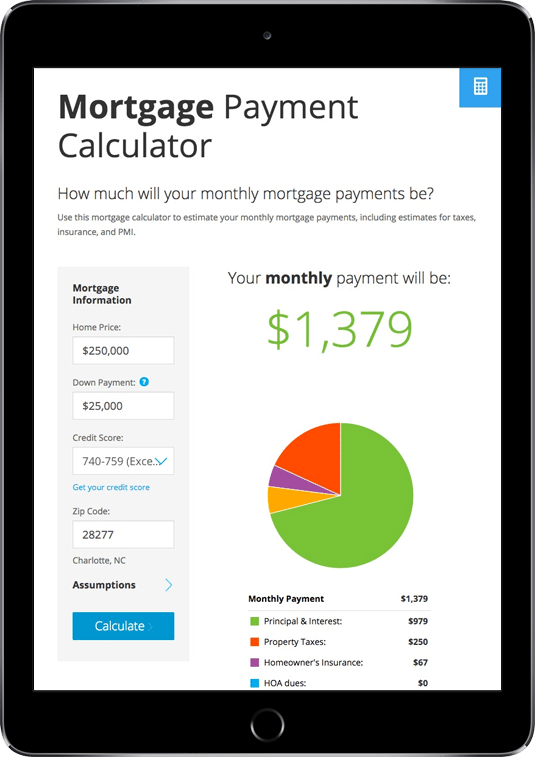

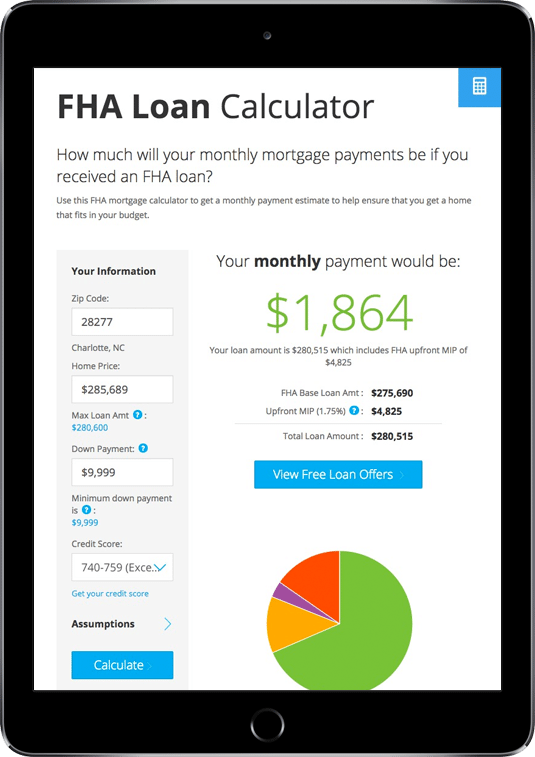

Mortgage Calculators Lendingtree They can visit a local bank or credit union, go to a direct mortgage lender such as Quicken Loans, or try to obtain multiple loan offers simultaneously by using a site like LendingTree Use this calculator to figure out what you will pay each month for your mortgage — the amount of money you intend to borrow to buy your new home Enter the numbers in the box for each item

Mortgage Calculators Lendingtree Many or all of the products here are from our partners that compensate us It’s how we make money But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation LendingTree also offers plenty of educational resources and support services, including information on current mortgage rates, loan calculators and a national loan officer directory The company Terms may apply to offers listed on this page There's a reason the 30-year mortgage is so popular with home buyers With a longer repayment schedule, you pay less each month than with a shorter LendingTree was launched in 1998, allowing consumers to compare mortgage lenders Since then, the company has expanded its marketplace to personal loans, student loans, small business loans

Mortgage Calculators Lendingtree Terms may apply to offers listed on this page There's a reason the 30-year mortgage is so popular with home buyers With a longer repayment schedule, you pay less each month than with a shorter LendingTree was launched in 1998, allowing consumers to compare mortgage lenders Since then, the company has expanded its marketplace to personal loans, student loans, small business loans In 2021, it changed its name again to Rocket Mortgage Rocket Mortgage offers a handful of different calculators on its website that can help you determine your homebuying budget, whether or not They can visit a local bank or credit union, go to a direct mortgage lender such as Quicken Loans, or try to obtain multiple loan offers simultaneously by using a site like LendingTree Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term Chris Jennings is a writer and editor with more than seven years of experience in the personal finance and mortgage space He enjoys simplifying complex mortgage topics for first-time homebuyers

Comments are closed.