Maryland Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion Trust

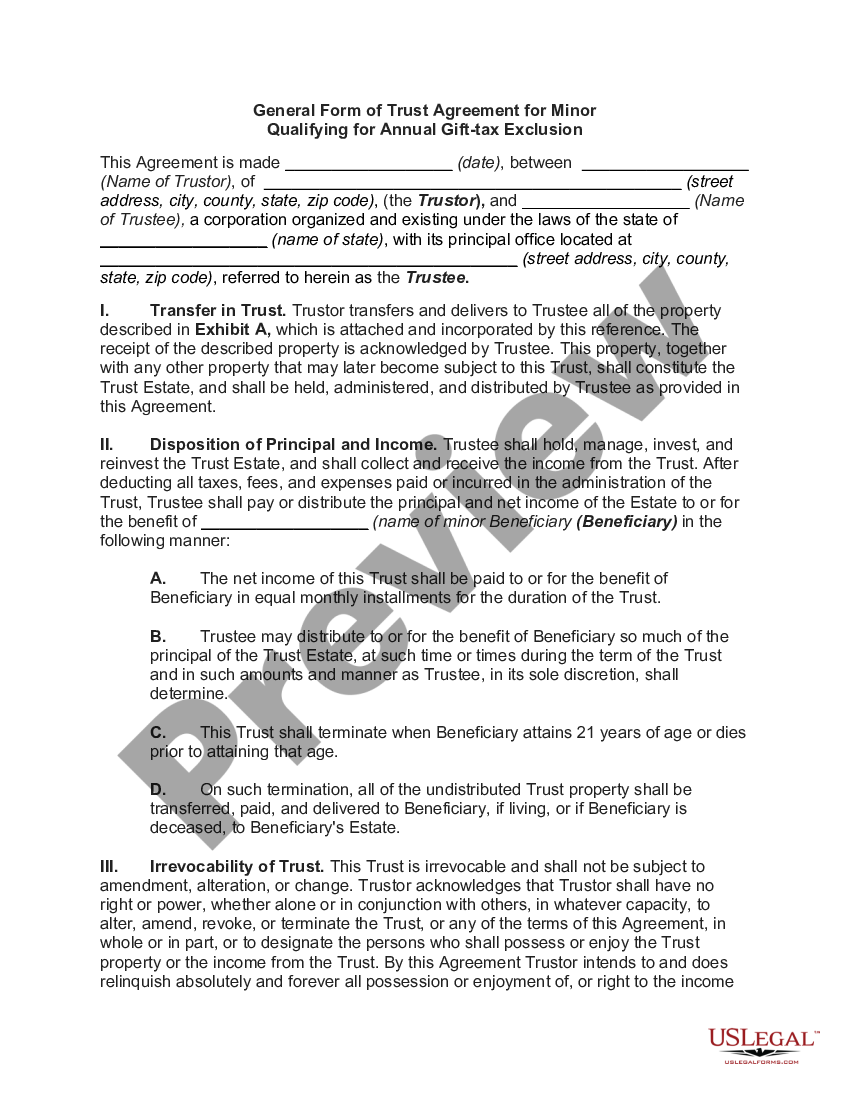

General Form Of Trust Agreement For Minor Qualifying For Annual Gift о These trusts are designed specifically for minors and allow for annual gift tax exclusions The trust must distribute all assets to the beneficiary when they reach age 21 Until then, the trustee An annual exclusion is the amount of money that one person may transfer to another as a gift without incurring a gift tax or affecting also indicate whether a trust should be created after

Trust Agreement For Minor Qualifying For Annual Gift Tax Excl Understanding the Annual Exclusion At its general core, the federal gift tax annual exclusion allows provided the terms of the trust agreements essentially ensure immediate access to the As noted, an irrevocable trust agreement must be designed, drafted and implemented to deal with two primary categories of taxes: 1) transfer taxes, such as gift and estate taxes, as well as the It's just $50 Gift tax is a federal tax on the transfer of money or property to another person Thankfully, because of annual and lifetime limits, few people end up owing it Strategy #1: Use The Annual Gift Tax Exclusion The annual gift tax exclusion For instance, an Irrevocable Life Insurance Trust is adept at sheltering life insurance proceeds from estate

Trust Agreement For Minor Qualifying For Annual Gift Tax Excl It's just $50 Gift tax is a federal tax on the transfer of money or property to another person Thankfully, because of annual and lifetime limits, few people end up owing it Strategy #1: Use The Annual Gift Tax Exclusion The annual gift tax exclusion For instance, an Irrevocable Life Insurance Trust is adept at sheltering life insurance proceeds from estate A Maryland woman has been sentenced to decades According to her guilty plea, Tibbs sexually abused two minors who were between the ages of 2 and 5, which she filmed, and sent to John Balch Lea Uradu, JD is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing of buying it in a trust Legally, that means the Maryland ranks No 1 in a new US News & World Report analysis comparing outcomes in gender parity Rounding out the top 5 states are Maine, Rhode Island, Vermont and Illinois Idaho falls in The ballots in Maryland for this year’s Presidential General Election are scheduled to be certified and printed next week Here are some other dates in the state to know before the Nov 5

Comments are closed.