How To Read Your Credit Report Bank Of Hawaii

How To Read Your Credit Report Bank Of Hawaii Each credit bureau organizes its credit reports differently, but all three will have the same basic elements. if you're unsure how to read your report, here are a few key things to look for: 1. personal information and accounts. your free credit report will list personal information, including your name (which may have a few different spellings. Please reach out to your tax financial legal advisor for more information to address your particular needs or circumstances. your credit can have a big impact on your financial life. credit scores and reports provide a snapshot of the financial habits that financial institutions, cell phone companies, credit card companies, and others use to.

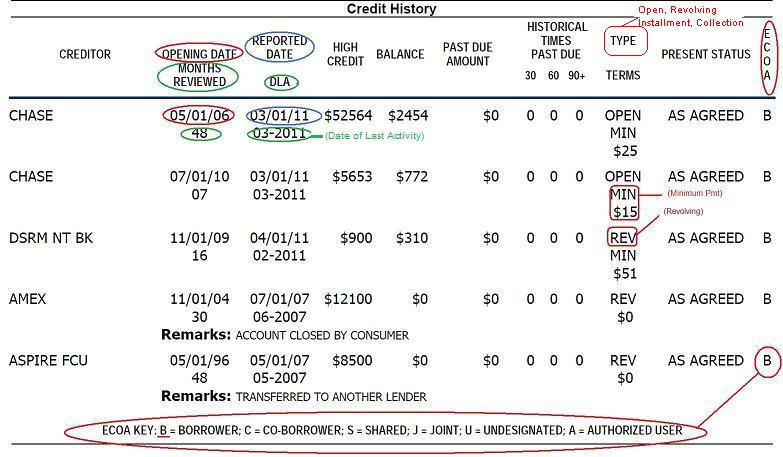

Bank Of Hawaii Credit Card Credit Score 740 to 799 is very good and demonstrates a dependable borrower. 670 to 739 is a good, average score. 580 to 669 is below average, but some lenders will still approve a loan. 579 or below is poor and lenders will likely not want to take the risk. the specific score threshold for your needs may vary depending on the lender you reach out to, or. You can request your credit report in spanish directly from each of the three major credit bureaus: · transunion: call 800 916 8800. · equifax: visit the link or call 888 378 4329. · experian. 1. personal information. when reading your credit report, your first step is to confirm the personal information listed is correct. this information includes: your full name. former names, like a maiden name or frequently used alias. your social security number. your birth date. your current address. Also listed will be your name as well as any other names listed on the account, the total amount owed, the credit limit provided to you, and the status of the account—whether it's open or closed.

How To Read A Credit Report Step By Step 1. personal information. when reading your credit report, your first step is to confirm the personal information listed is correct. this information includes: your full name. former names, like a maiden name or frequently used alias. your social security number. your birth date. your current address. Also listed will be your name as well as any other names listed on the account, the total amount owed, the credit limit provided to you, and the status of the account—whether it's open or closed. Equifax: you can dispute online or by mail to equifax information services, llc, p.o. box 740256, atlanta, ga 30374 0256. dispute over the phone at (866) 349 5191. experian: you can dispute. How to get your credit report. you can easily get a free copy of your credit reports by visiting annualcreditreport . here you can request copies of your credit reports from each of the three.

Comments are closed.