How To Eliminate Mortgage Insurance Premium From Fha Loans

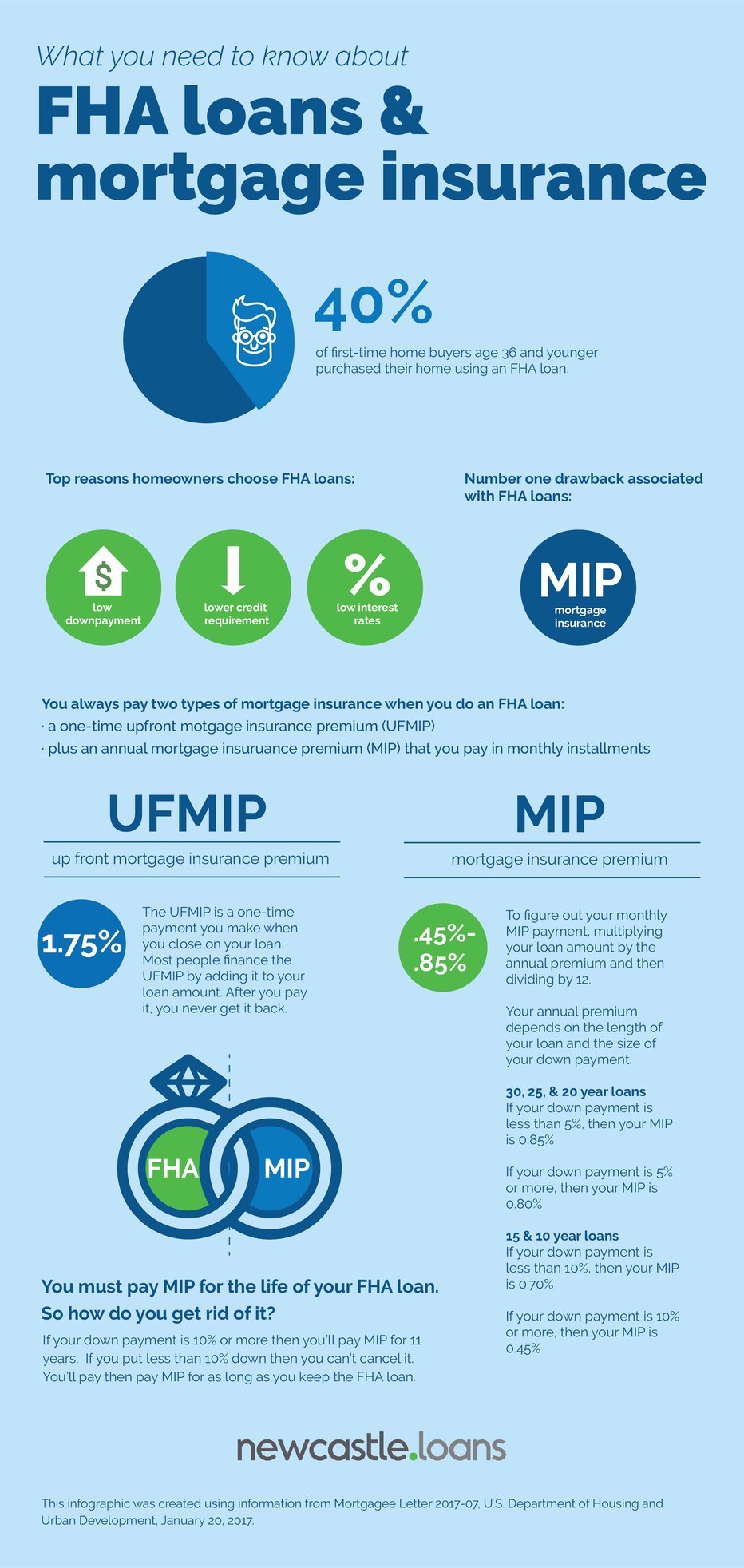

How To Get Rid Of Fha Mortgage Insurance Step by step guide to removing fha mortgage insurance. 1. check your eligibility. “there are a number of factors that come into play when determining whether or not the fha mortgage insurance. Put 5 percent down on a 30 year loan: your annual mip rate would go down to 0.8 percent for the life of the loan. put 10 percent or more down on a 30 year loan: you’d pay an annual mip of 0.8 percent for 11 years. put 10 percent or more down on a 15 year loan: you’d pay a 0.45 percent annual mip rate for 11 years.

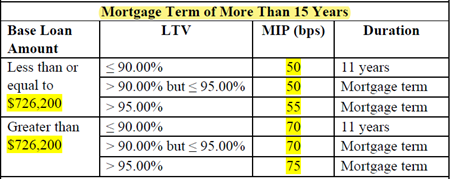

How To Eliminate Mortgage Insurance Premium From Fha Loans Youtube Below is a summary of the requirements you need to meet in order to request the removal of fha mortgage insurance. year of fha origination. mip removal eligibility. 2001 – june 2013. ltv ratio. To remove your fha loan’s mortgage insurance premiums, you’ll need to qualify under specific requirements. if your mortgage originated before june 3, 2013, you’d need to meet the following conditions: you’ve made all monthly mortgage payments on time. you’ve paid for at least 5 years of a 20, 25 or 30 year loan. Step 3: contact your lender to start the fha mip removal process. if you think you’re eligible for fha mortgage insurance removal, the next step is to contact your loan servicer. your servicer. Step by step guide to removing fha mortgage insurance. 1. check your eligibility. “there are a number of factors that come into play when determining whether or not the fha mortgage insurance.

Fha Announce Reduced Mortgage Insurance Costs For 2023 Step 3: contact your lender to start the fha mip removal process. if you think you’re eligible for fha mortgage insurance removal, the next step is to contact your loan servicer. your servicer. Step by step guide to removing fha mortgage insurance. 1. check your eligibility. “there are a number of factors that come into play when determining whether or not the fha mortgage insurance. Mortgage insurance can range from 0.5% and 2% of the original mortgage per year. for fha loans, however, the government recently reduced insurance premiums by 30 basis points – from 0.85% to 0.55% – per year for most homebuyers. 2. consider your options. you can remove fha mortgage insurance with one of two methods: automatic mip cancellation or refinancing your fha loan. mip cancellation. if you meet the eligibility.

Comments are closed.