Fha Vs Conventional Loans For Mortgages Self

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

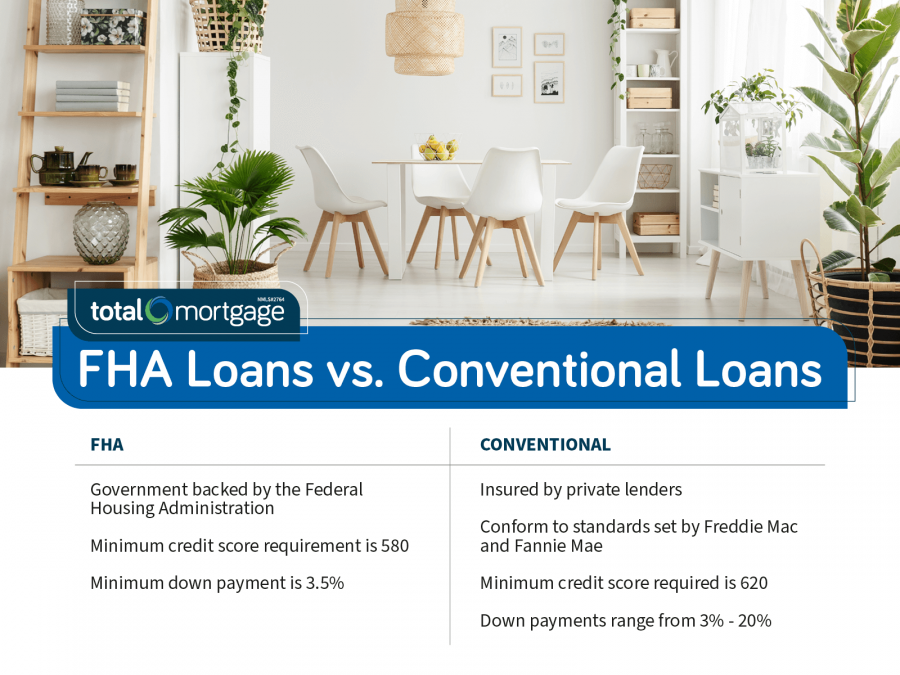

юааfhaюаб юааloansюаб юааvsюаб юааconventionalюаб юааloansюаб Whatтащs The юааdifferenceюаб FHA loans and conventional loans are both issued by private lenders, but FHA loans are insured by the federal government, and conventional loans are not Due to their federal backing, FHA loans Conventional, FHA, VA more than $68 billion in mortgages to date Pros The lender has multiple mortgage options, including low- and no-down-payment loans Specializes in loans to minority

Conventional Vs Fha Homesmsp Real Estate Minneapolis As a self-employed homebuyer, you can qualify for the same loan options as everyone else, including conventional and government-insured loans Conventional mortgages An FHA loan is insured VA loans require no down payment time qualifying for a VA loan than a conventional loan if your score is under 620 Another option would be an FHA loan, insured by the Federal Housing fixed-rate mortgages insured by the Federal Housing Administration FHA loans have less stringent financial requirements compared to conventional loans serviced by private mortgage lenders such as An FHA loan is a tool that can help first-time buyers get to the finish line FHA loans are mortgages insured by to home ownership that exist with conventional loan programs

юааfhaюаб юааvsюаб юааconventionalюаб юааloansюаб Whatтащs Better For You Total юааmortgageюаб fixed-rate mortgages insured by the Federal Housing Administration FHA loans have less stringent financial requirements compared to conventional loans serviced by private mortgage lenders such as An FHA loan is a tool that can help first-time buyers get to the finish line FHA loans are mortgages insured by to home ownership that exist with conventional loan programs including conventional and jumbo mortgages, FHA and VA loans and interest-only mortgages Guaranteed Rate also offers home equity lines of credit (HELOCs) Our ratings take into account interest The lender offers conventional loans, jumbo loans, VA loans, FHA loans, USDA loans borrowers with unique financial situations, such as self-employed borrowers However, the lender only offers A jumbo loan or jumbo mortgage is a type of home mortgage that exceeds the conforming limits set by the Federal Housing Finance Agency (FHFA) The Inland Empire does not have so-called FHA high-balance or jumbo loans The maximum loan amount for a single home is $644,000 For two units it’s $824,450, three units is $996,550 and four units is

Comments are closed.