Fha Vs Conventional Loans Difference And Comparison

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

юааfhaюаб юааloansюаб юааvsюаб юааconventionalюаб юааloansюаб Whatтащs The юааdifferenceюаб Compare fha and conventional loans to find the best mortgage for you. learn about their pros, cons and differences with nerdwallet. Fha loan interest rates run slightly lower than their conventional counterparts: in mid may, for example, a 30 year fixed fha loan for a $400,000 house was 6.8 percent, vs. 7 percent for a.

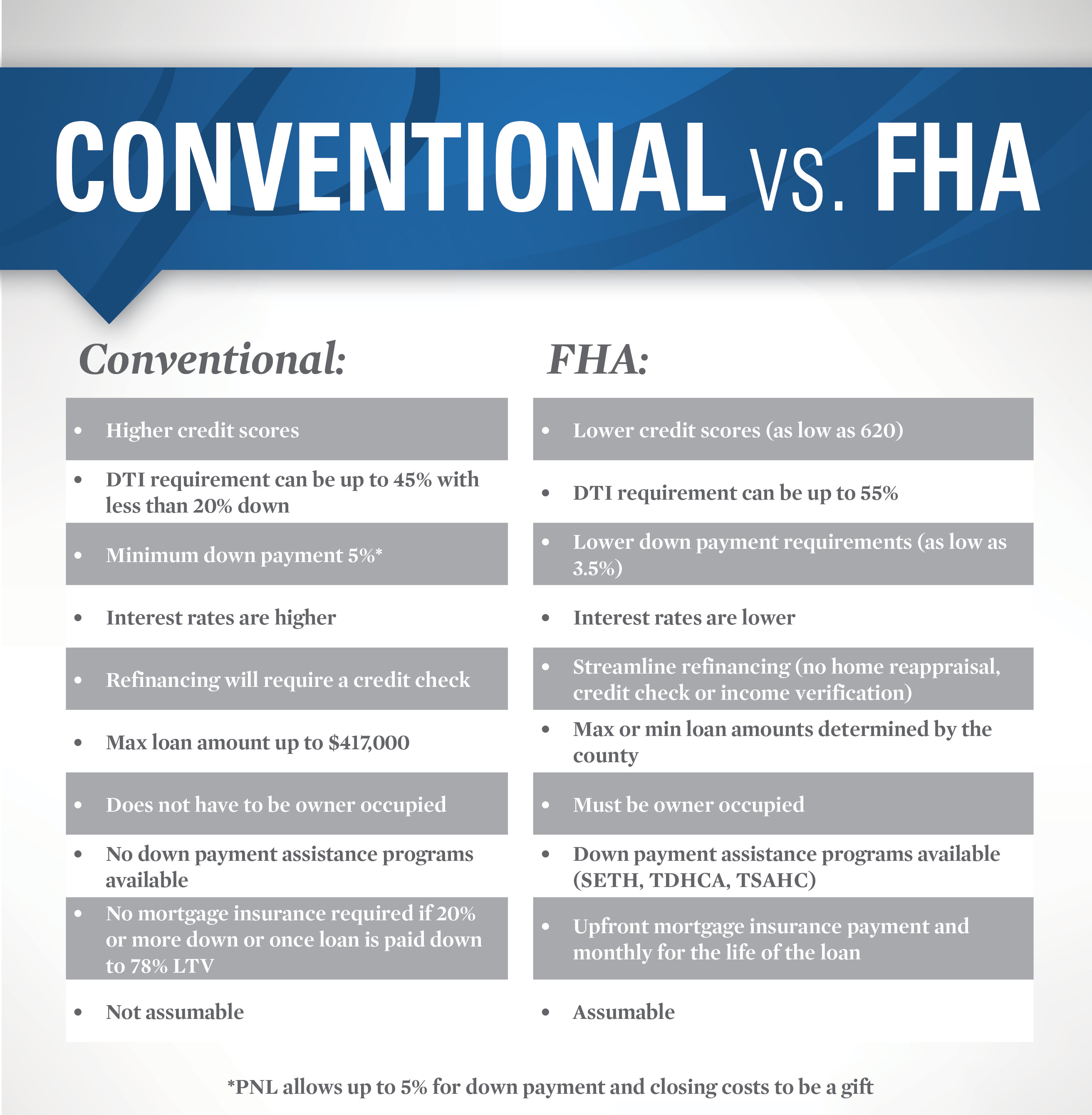

Conventional Vs Fha Homesmsp Real Estate Minneapolis Conventional loan vs fha comparison. there are plenty of low down payment options for today’s home buyers. but many will choose either a conventional loan with 3% down or an fha loan with 3.5%. If your credit score is between 500 and 579, you’ll be asked to make a 10% down payment. here’s an example of how much you’d pay for a down payment on both types of loans: conventional loan down payment of 3% on a $400,000 house: $12,000. fha loan down payment of 3.5% on a $400,000 house: $14,000. fha vs. Fha loans allow smaller down payments (as low as 3.5%) and lower credit scores than most conventional loans. unlike fha loans, conventional loans are not insured or guaranteed by the government. Fha loans are normally priced lower than comparable conventional loans. also fha loans are assumable loans; this may be a particularly good future resale point if the borrower would have an existing low interest rate on the home they are selling. that interest rate and mortgage balance can be assumed by a new buyer.

Difference Between Fha And Conventional Mortgage Your Mortgage Guy For Life Fha loans allow smaller down payments (as low as 3.5%) and lower credit scores than most conventional loans. unlike fha loans, conventional loans are not insured or guaranteed by the government. Fha loans are normally priced lower than comparable conventional loans. also fha loans are assumable loans; this may be a particularly good future resale point if the borrower would have an existing low interest rate on the home they are selling. that interest rate and mortgage balance can be assumed by a new buyer. Fha loan mortgage insurance is generally more expensive than conventional mortgage insurance because fha lenders take on more risk approving loans to lower credit score borrowers. however, if you have a high credit score, you may find that you’ll pay less with conventional mortgage insurance. → fha mortgage insurance: upfront and annual. Fha vs. conventional loan overview. conventional loans and fha loans are two types of mortgages you can use to pay for a home. the key difference between the two is that fha loans are insured by.

Comments are closed.