Fha Vs Conventional Loans 2022 Loanwithjen Conventionalloans Fhaloans

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

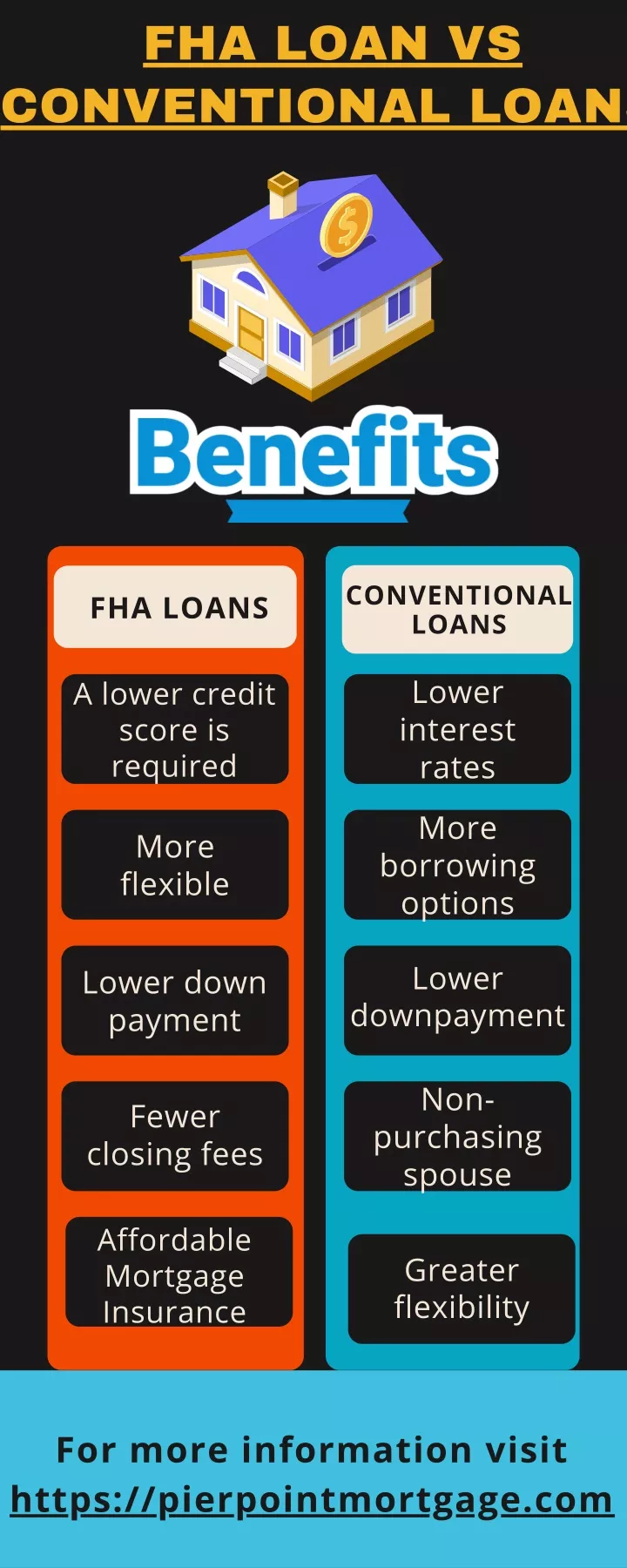

юааfha Loansюаб юааvsюаб юааconventional Loansюаб Whatтащs The юааdifferenceюаб FHA loans and conventional loans are both issued by private lenders, but FHA loans are insured by the federal government, and conventional loans are not Due to their federal backing, FHA loans Loans that are insured by the FHA have lower down payment requirements than conventional loans and tend family home is currently $420,680 for 2022 Can I get an FHA loan with a low credit

Conventional Loans Vs Fha Loans Ez Fundings Home Loans Credible is solely responsible for this content and the services it provides Conventional and FHA loans are the two most common hom loan types, totaling over 250,000 loans granted in the third FHA loans aren’t designed for second homes or investment properties You could pay more: When you compare mortgage rates between FHA and conventional loans, you might notice lower FHA interest Purchase flexibility: You can use a conventional loan to purchase a first home, second home or investment property You can only use FHA loans to finance a primary residence Cons Stricter credit Jennifer Nelson writes about all things money--personal finance, investing, saving, credit cards and insurance for numerous publications including AARP, Next Avenue, Credit Karma, Real SImple

Ppt Conventional Loans Vs Fha Loans Powerpoint Presentation Free Download Id 11567 Purchase flexibility: You can use a conventional loan to purchase a first home, second home or investment property You can only use FHA loans to finance a primary residence Cons Stricter credit Jennifer Nelson writes about all things money--personal finance, investing, saving, credit cards and insurance for numerous publications including AARP, Next Avenue, Credit Karma, Real SImple For conventional loans, you typically need a credit score of at least 620 However, government-backed loans like FHA, VA and USDA loans may have more lenient credit requirements – as low as 500 VA loans require no down payment time qualifying for a VA loan than a conventional loan if your score is under 620 Another option would be an FHA loan, insured by the Federal Housing Conventional loans are the main engine driving the home mortgage machine — the go-to loan product for most borrowers More than half of all purchase mortgages were conventional loans in 2022 As a trusted personal finance writer and mortgage specialist, Maryalene LaPonsie has interviewed hundreds of certified financial planners, CPAs and wealth advisors, and distills their expertise

Conventional Vs Fha Homesmsp Real Estate Minneapolis For conventional loans, you typically need a credit score of at least 620 However, government-backed loans like FHA, VA and USDA loans may have more lenient credit requirements – as low as 500 VA loans require no down payment time qualifying for a VA loan than a conventional loan if your score is under 620 Another option would be an FHA loan, insured by the Federal Housing Conventional loans are the main engine driving the home mortgage machine — the go-to loan product for most borrowers More than half of all purchase mortgages were conventional loans in 2022 As a trusted personal finance writer and mortgage specialist, Maryalene LaPonsie has interviewed hundreds of certified financial planners, CPAs and wealth advisors, and distills their expertise Conventional, FHA, VA The financial institution says it is one of the few that funds VA and FHA loans in all 50 states Pros You may qualify for a mortgage if you have fair credit

Comments are closed.