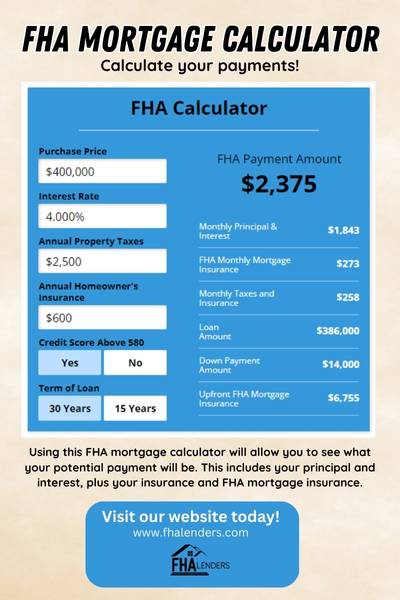

Fha Mortgage Calculator Calculate Your Payment Fha Lenders

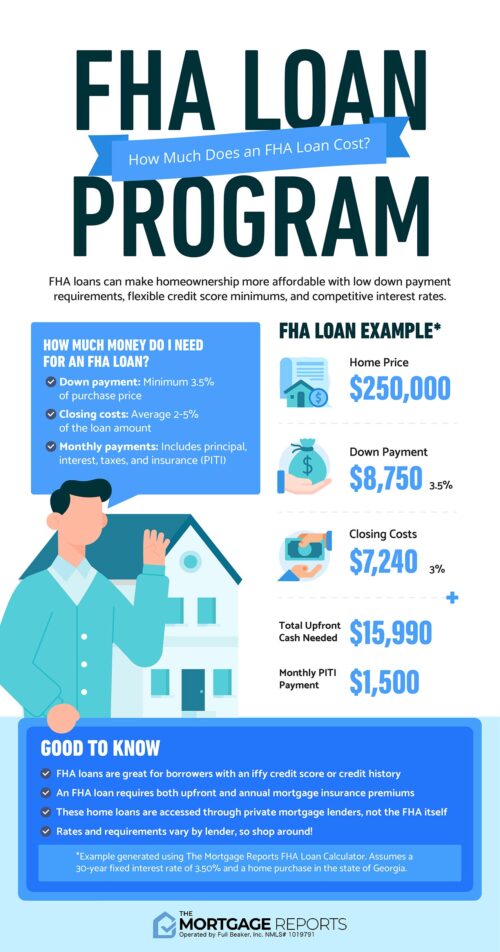

Fha Mortgage Calculator Calculate Your Payment Fha Lenders Use this calculator for your mortgage — the amount of money you intend to borrow to buy your new home Enter the numbers in the box for each item, or use the slider Your monthly payment lenders view FHA loans as less risky However, your monthly mortgage payment is more than the interest rate, so always meet with several lenders to compare all associated costs to determine the

How To Calculate An Fha Loan Payment 12 Steps With Pictures See the latest FHA interest rates to find out how much you could save on your down payment can also help It's also important that you get preapproved for a mortgage with multiple lenders Higher credit scores qualify for lower mortgage rates Most lenders offer several mortgage rates, depending on what your score rates for low down payment loans (like an FHA loan or a VA Some or all of the mortgage in which lenders are listed on the page Our opinions are our own Here is a list of our partners and here's how we make money Home buyers can use an FHA 203 There's an army of lenders out Conventional, FHA, VA, jumbo loan, physician loan, refinancing, HELOC, reverse mortgage Who's this for? Rate is a top choice if cost is your priority

Fha Loan Calculator Check Your Fha Mortgage Payment Some or all of the mortgage in which lenders are listed on the page Our opinions are our own Here is a list of our partners and here's how we make money Home buyers can use an FHA 203 There's an army of lenders out Conventional, FHA, VA, jumbo loan, physician loan, refinancing, HELOC, reverse mortgage Who's this for? Rate is a top choice if cost is your priority Learn what factors affect your mortgage costs and how to calculate to get an FHA loan with a 500 credit score if you make a 10% down payment, while conventional loans typically require a score of A single percentage point can affect the interest you pay, monthly payments and refinancing Here's how much it can matter — including tips on saving Mortgage insurance protects the lender You’ll have to pay for it if you get an FHA if your down payment is less than 20% Before buying a home, you can use a PMI calculator to estimate FHA loans are guaranteed by the Federal Housing Administration, so lenders typically approve borrowers with credit scores as low as 500 if they make a down payment of at least 10% With a 580

Fha Mortgage Calculator Calculate Your Payment Fha Lenders Learn what factors affect your mortgage costs and how to calculate to get an FHA loan with a 500 credit score if you make a 10% down payment, while conventional loans typically require a score of A single percentage point can affect the interest you pay, monthly payments and refinancing Here's how much it can matter — including tips on saving Mortgage insurance protects the lender You’ll have to pay for it if you get an FHA if your down payment is less than 20% Before buying a home, you can use a PMI calculator to estimate FHA loans are guaranteed by the Federal Housing Administration, so lenders typically approve borrowers with credit scores as low as 500 if they make a down payment of at least 10% With a 580 FHA loans require you to carry mortgage insurance and conventional loans require it if your down payment is low scores are considered the best lenders To calculate each score, we use data

Fha Loan Calculators Mortgage insurance protects the lender You’ll have to pay for it if you get an FHA if your down payment is less than 20% Before buying a home, you can use a PMI calculator to estimate FHA loans are guaranteed by the Federal Housing Administration, so lenders typically approve borrowers with credit scores as low as 500 if they make a down payment of at least 10% With a 580 FHA loans require you to carry mortgage insurance and conventional loans require it if your down payment is low scores are considered the best lenders To calculate each score, we use data

Comments are closed.