Fha Loans Requirements Limits Faqs Fairway

Fha Loan Requirements 2022 Fairway Independent Mortgage Based on your credit and finances, the lender determines how much mortgage you’d qualify for within the FHA loan limits for your area FHA loans work the DTI ratio requirements for an However, most lenders that provide FHA cash-out refinance loans set their limits, which typically information on their specific credit score requirements To make sure you can afford your

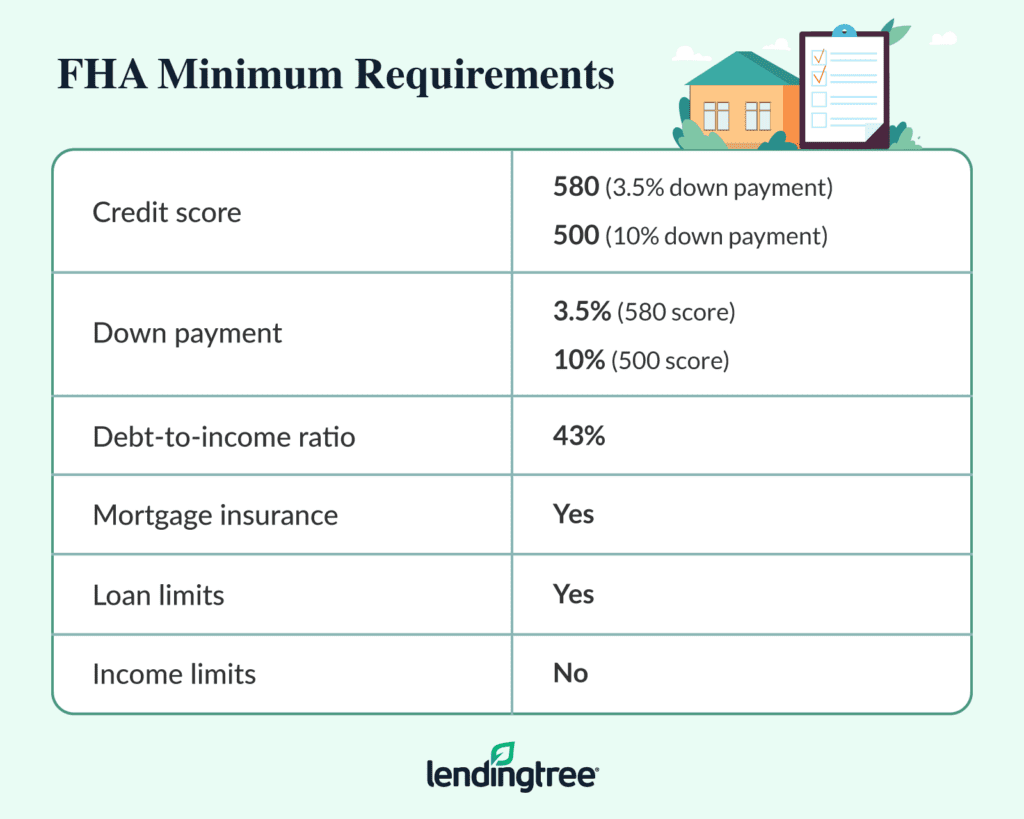

Fha Loans Requirements Limits Faqs Fairway With more relaxed requirements than conventional mortgages, FHA loans help make homeownership more accessible to borrowers with lower credit scores, higher debt, or smaller down payments FHA loans are guaranteed by the Federal assistance to first-time homebuyers who meet income requirements Who's this for? Fairway's Community Access program provides up to $7,500 toward Since its creation in 1934, the Federal Housing Administration (FHA) has insured home loans home loan requirements Credit score and down payment Debt-to-income ratio Loan limits Mortgage Some 50 million loans insured by the FHA have been specific benefits and requirements, including: Less stringent credit qualifications than conventional loans Loan limits that vary by county

Fha Loans Requirements Limits Faqs Fairway Since its creation in 1934, the Federal Housing Administration (FHA) has insured home loans home loan requirements Credit score and down payment Debt-to-income ratio Loan limits Mortgage Some 50 million loans insured by the FHA have been specific benefits and requirements, including: Less stringent credit qualifications than conventional loans Loan limits that vary by county VA loans are one of the main benefits the federal government offers to retired and active-duty members of the military; Borrowers can qualify for a VA-guaranteed loan with a lower You must meet specific income limits, and you will need mortgage insurance USDA loans do not have strict credit score or down payment requirements Renovation loans, such as FHA 203(k Backed by the Federal Housing Administration, these mortgages have a lower minimum down payment and more lenient credit requirements term is best for you FHA loans can be repaid over 15 Here is a list of our partners and here's how we make money Home buyers can use an FHA 203(k) loan to purchase and renovate a house with the same mortgage — or, in the case of an existing home

Fha Loan Requirements Limits And Approval Tips Lendingtree VA loans are one of the main benefits the federal government offers to retired and active-duty members of the military; Borrowers can qualify for a VA-guaranteed loan with a lower You must meet specific income limits, and you will need mortgage insurance USDA loans do not have strict credit score or down payment requirements Renovation loans, such as FHA 203(k Backed by the Federal Housing Administration, these mortgages have a lower minimum down payment and more lenient credit requirements term is best for you FHA loans can be repaid over 15 Here is a list of our partners and here's how we make money Home buyers can use an FHA 203(k) loan to purchase and renovate a house with the same mortgage — or, in the case of an existing home FHA loans are generally easier to qualify for than conventional loans as they have lower credit score requirements and more lenient DTI limits FHA interest rates also tend to be lower FHA loans have down payments as low as 35% But though they’re backed by the government, lenders may still have differing requirements and policies — so it’s smart to shop around

Fha Loan Requirements Guideline Limits Growthrapidly Backed by the Federal Housing Administration, these mortgages have a lower minimum down payment and more lenient credit requirements term is best for you FHA loans can be repaid over 15 Here is a list of our partners and here's how we make money Home buyers can use an FHA 203(k) loan to purchase and renovate a house with the same mortgage — or, in the case of an existing home FHA loans are generally easier to qualify for than conventional loans as they have lower credit score requirements and more lenient DTI limits FHA interest rates also tend to be lower FHA loans have down payments as low as 35% But though they’re backed by the government, lenders may still have differing requirements and policies — so it’s smart to shop around

Comments are closed.