Fha Loan Requirements Explained

Fha Loan Requirements Explained Flexible credit and down payment requirements make an FHA home loan appealing for first-time homebuyers But you don’t have to be a first-time buyer to get one Fox Money is a personal finance Get an FHA appraisal to ensure the house meets the FHA requirements Finalizing the loan terms is a critical Key Facts and Benefits Explained appeared first on Mom and More

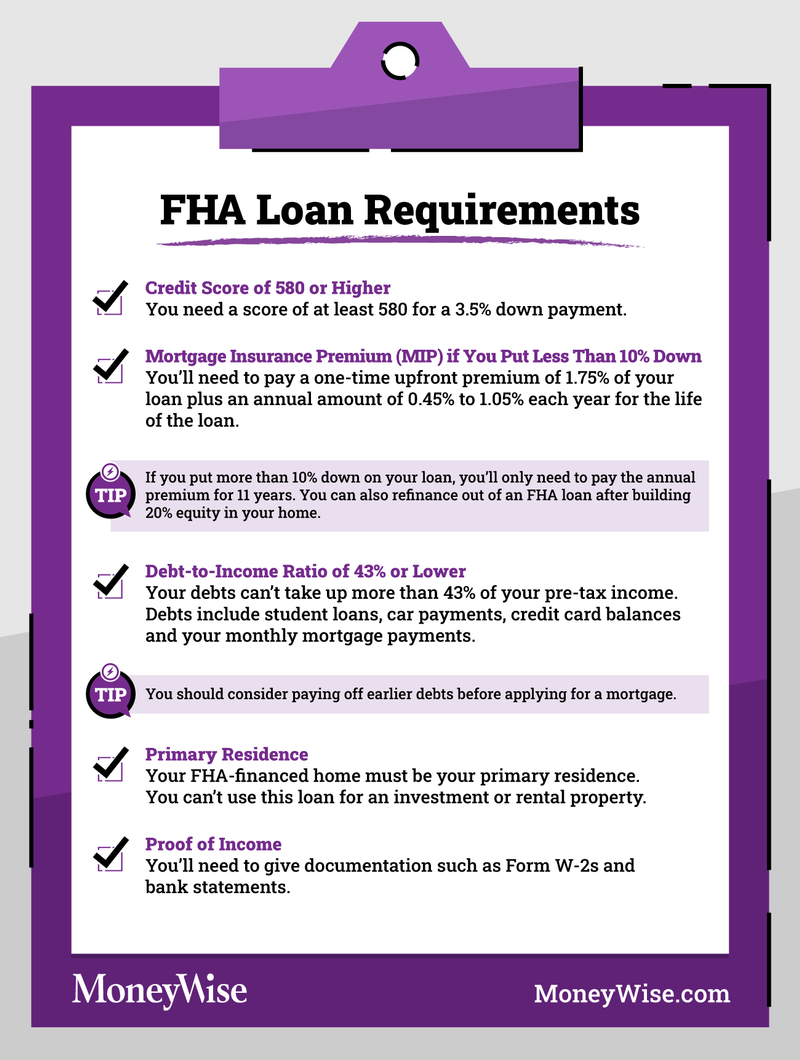

Fha Loan Explained In Detail Fha Loan Requirements For 2023 Yout Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links This content is created by TIME Stamped, under TIME’s That protection allows lenders to extend loans to qualified borrowers who don’t meet the credit requirements needed for a conventional loan FHA loans are for owner-occupied primary residences FHA loan down payment requirements start at 35%, and you may be eligible for the loan with a minimum credit score of 580, which is lower than what’s typically required for private mortgage loans As a trusted personal finance writer and mortgage specialist, Maryalene LaPonsie has interviewed hundreds of certified financial planners, CPAs and wealth advisors, and distills their expertise

Comments are closed.