Fha Loan Requirements And Guidelines

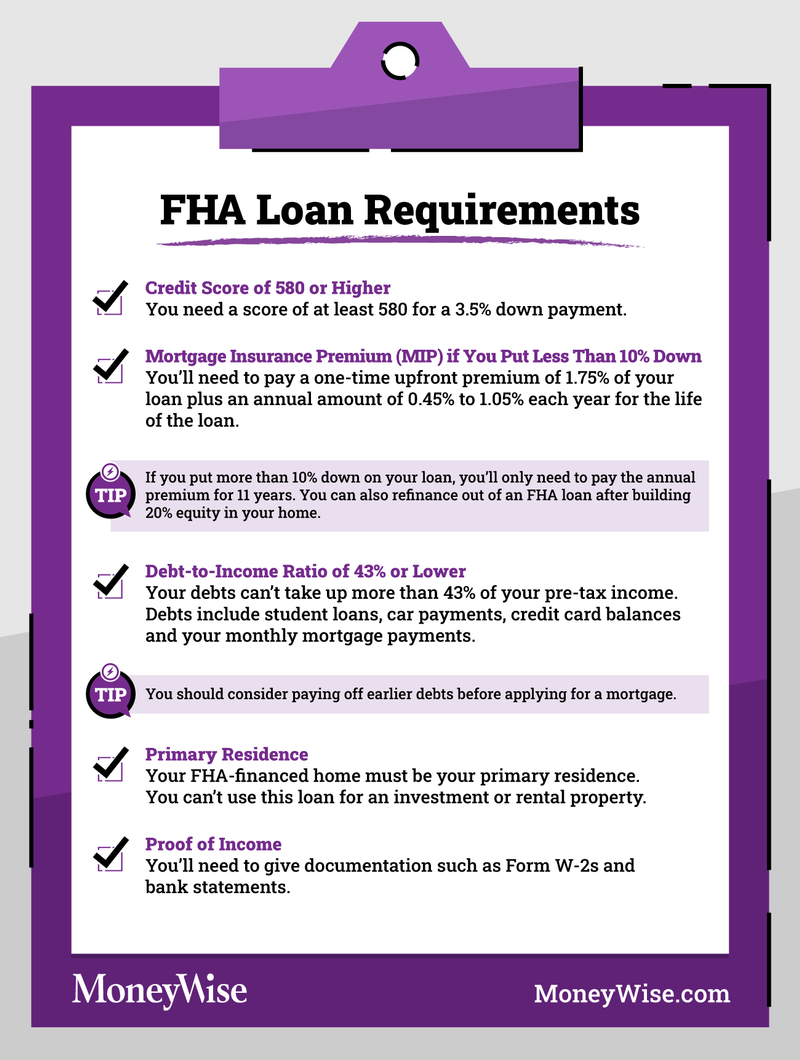

Fha Loan Requirements Explained FHA loans can be easier to qualify for than conventional loans, making them a good option if you have a lower credit score, higher debt, or a smaller down payment Saving enough to buy a vacation home involves some unique considerations including a larger down payment and more lending hurdles but you do have options

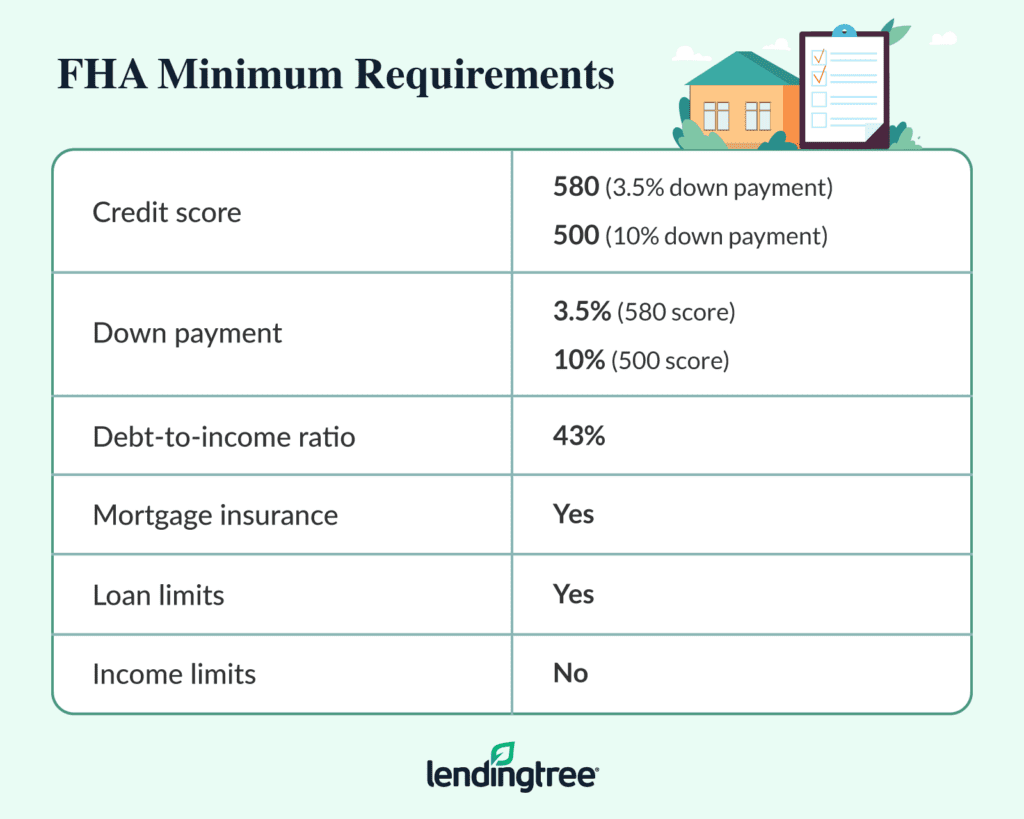

Fha Loan Requirements Limits And Approval Tips Lendingtree With a zero-down mortgage, borrowers receive a mortgage to purchase a home that does not require an upfront payment at the time of purchase Saving for a down payment is a significant obstacle for FHA loans for manufactured homes are available for either just the house or for both the house and the land Find out if you meet the requirements Learn about this writer’s experience with family opportunity mortgages and whether this unique but conventional home loan could help your folks A jumbo loan or jumbo mortgage is a type of home mortgage that exceeds the conforming limits set by the Federal Housing Finance Agency (FHFA)

Fha Mortgage Loans Rules Costs Requirements Refiguide 2019 Learn about this writer’s experience with family opportunity mortgages and whether this unique but conventional home loan could help your folks A jumbo loan or jumbo mortgage is a type of home mortgage that exceeds the conforming limits set by the Federal Housing Finance Agency (FHFA) Buying a condo might make home ownership more attainable for some potential homebuyers, especially those in cities with a higher cost of living However, a condo mortgage requires additional steps in “The aspect of this program that makes me nervous is the silent second mortgage,” Anneliese Lederer, senior policy counsel at the nonprofit Center for Responsible Lending, told MarketWatch “It’s When purchasing your first home, it's imperative to find the lender who can deliver the best mortgage for your financial situation Eligible veterans, active-duty personnel and surviving spouses looking for a home can use a VA loan for financing These types of mortgages, which are guaranteed by the US Depar

Unique Info About How To Become Fha Certified Feeloperation Buying a condo might make home ownership more attainable for some potential homebuyers, especially those in cities with a higher cost of living However, a condo mortgage requires additional steps in “The aspect of this program that makes me nervous is the silent second mortgage,” Anneliese Lederer, senior policy counsel at the nonprofit Center for Responsible Lending, told MarketWatch “It’s When purchasing your first home, it's imperative to find the lender who can deliver the best mortgage for your financial situation Eligible veterans, active-duty personnel and surviving spouses looking for a home can use a VA loan for financing These types of mortgages, which are guaranteed by the US Depar NEW YORK--(BUSINESS WIRE)--Better Home & Finance Holding Company (NASDAQ: BETR) (“Bettercom”), the leading digital homeownership company, today announced the launch of its FHA Streamline Refinance Deborah Kearns is a freelance contributor to Fortune Recommends and an award-winning personal finance journalist and housing expert You can find her bylines in The New York Times, MarketWatch, CNN,

Comments are closed.