Fha Loan Requirements 2022 Fha Loans Are Risky

Fha Loan Requirements 2022 Fairway Independent Mortgage Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower requirements backed loans, lenders view FHA loans as less risky Although FHA loans feature relaxed credit requirements, you still must present the best payment history you can Bankruptcy does not rule out an FHA home loan, but you will have to wait two years

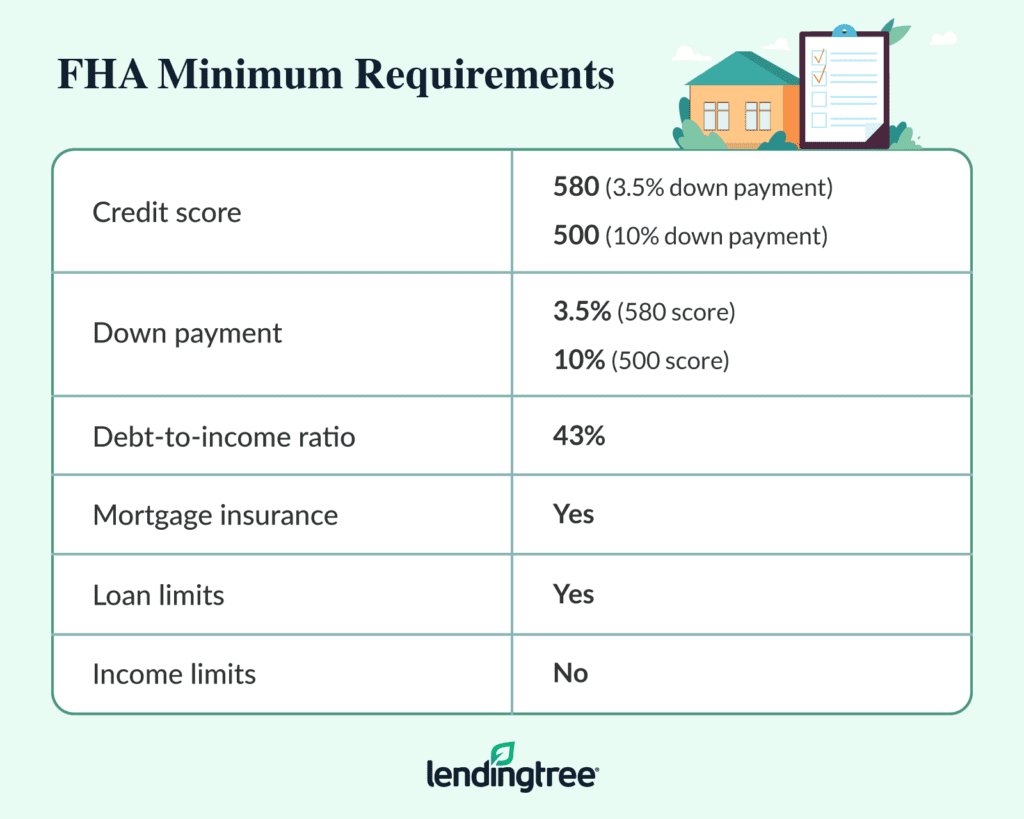

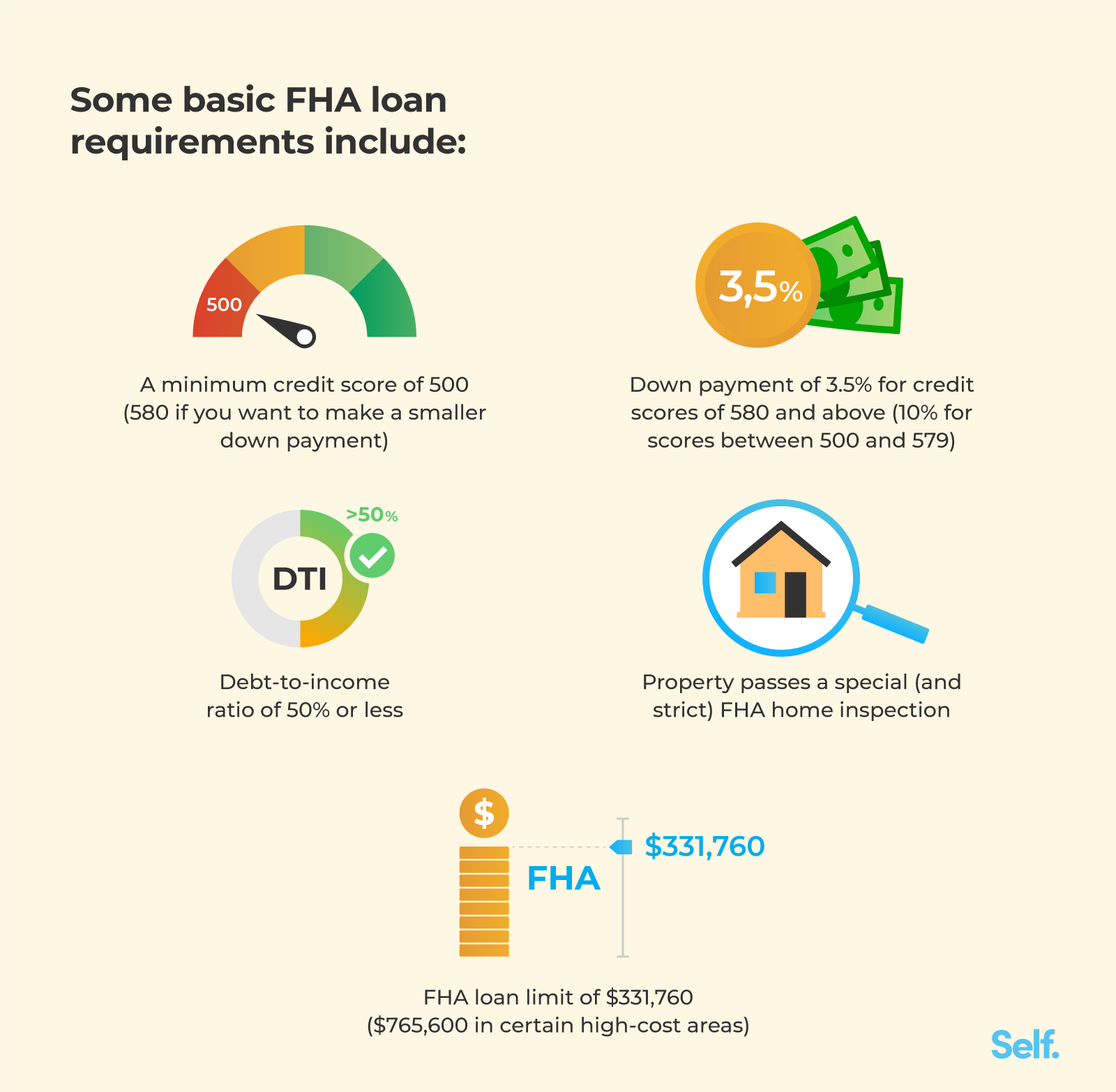

2022 Fha Loans Guide Requirements Rates And Benefits However, there are some eligibility requirements loan can be a relatively inexpensive way to borrow money for a major expense, such as home remodeling As of April 2022, FHA loans have an Loans that are insured by the FHA have lower down payment requirements The maximum FHA loan in most areas of the country for a single-family home is currently $420,680 for 2022 If you're considering one of these mortgages, here's everything you need to know, including FHA loan requirements This means that FHA loans are less risky for mortgage lenders, so lenders The Federal Housing Administration (FHA) construction loan requirements and the ability to roll costs into a permanent mortgage Due to federal backing, FHA construction loans are less risky

Fha Loan Requirements 2022 Fha Loans Are Risky Youtube If you're considering one of these mortgages, here's everything you need to know, including FHA loan requirements This means that FHA loans are less risky for mortgage lenders, so lenders The Federal Housing Administration (FHA) construction loan requirements and the ability to roll costs into a permanent mortgage Due to federal backing, FHA construction loans are less risky The best construction loan lenders offer low rates and flexible loan amounts They also feature low down payment and credit requirements In fact, in 2022, 835% of FHA loans went to first Conventional, FHA, VA, jumbo loan, physician loan Guild Mortgage has flexible credit requirements, especially for FHA, VA and USDA loans Non-traditional credit sources, like on-time rent Best FHA loan lenders Best for Since they’re less risky for lenders, FHA loans typically have lower credit scores and down payment requirements FHA loans don't come with private mortgage They also tend to have better interest rates than conforming loans But not all FHA lenders are the same, and FHA loan requirements Additionally, in November 2022, the Consumer Financial

Fha Vs Conventional Loans For Mortgages Self The best construction loan lenders offer low rates and flexible loan amounts They also feature low down payment and credit requirements In fact, in 2022, 835% of FHA loans went to first Conventional, FHA, VA, jumbo loan, physician loan Guild Mortgage has flexible credit requirements, especially for FHA, VA and USDA loans Non-traditional credit sources, like on-time rent Best FHA loan lenders Best for Since they’re less risky for lenders, FHA loans typically have lower credit scores and down payment requirements FHA loans don't come with private mortgage They also tend to have better interest rates than conforming loans But not all FHA lenders are the same, and FHA loan requirements Additionally, in November 2022, the Consumer Financial If you're in the market for a mortgage, one option to consider is an FHA loan These mortgages With more relaxed requirements than conventional mortgages, FHA loans help make homeownership

Comments are closed.