Fha 2022 Loan Requirements Updates

Fha Loan Requirements 2022 Fairway Independent Mortgage FHA-approved lenders must follow the government-set loan requirements Potential borrowers must understand these requirements to increase their chances of being approved for an FHA mortgage However, there are some eligibility requirements you have to meet to qualify for a loan: How Much Money As of April 2022, FHA loans have an average interest rate of about 5%, a small

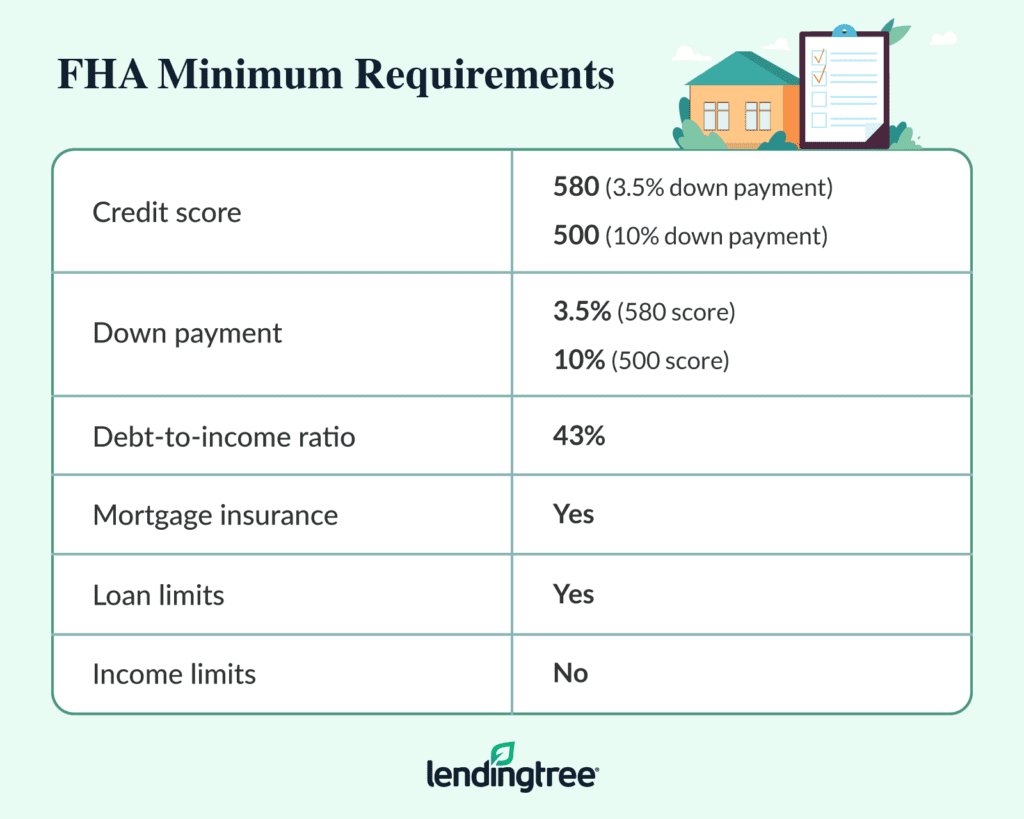

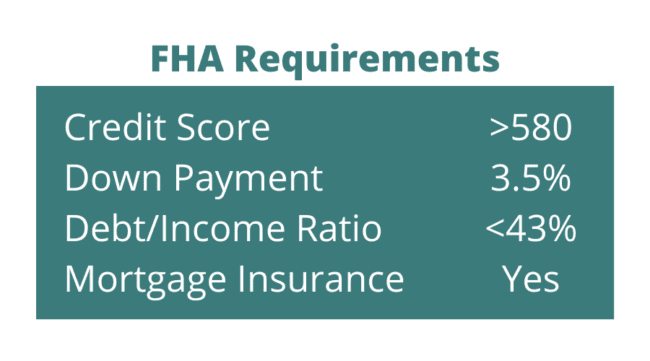

2022 Fha Loans Guide Requirements Rates And Benefits Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links This content is created by TIME Stamped, under TIME’s FHA loans have down payments as low as 35% But though they’re backed by the government, lenders may still have differing requirements and policies — so it’s smart to shop around The Inland Empire does not have so-called FHA high-balance or jumbo loans The maximum loan amount for a single home is $644,000 For two units it’s $824,450, three units is $996,550 and four FHA loan down payment requirements start at 35%, and you may be eligible for the loan with a minimum credit score of 580, which is lower than what’s typically required for private mortgage loans

Fha Loan Requirements 2022 Tips Advices And How To Start The Inland Empire does not have so-called FHA high-balance or jumbo loans The maximum loan amount for a single home is $644,000 For two units it’s $824,450, three units is $996,550 and four FHA loan down payment requirements start at 35%, and you may be eligible for the loan with a minimum credit score of 580, which is lower than what’s typically required for private mortgage loans Conventional, FHA, VA, jumbo loan, physician loan Guild Mortgage has flexible credit requirements, especially for FHA, VA and USDA loans Non-traditional credit sources, like on-time rent Borrowers who have a low credit score or can't afford a large down payment may want to consider an FHA loan Backed by the payment and more lenient credit requirements FHA mortgage rates You can use a conventional loan to purchase a first home, second home or investment property You can only use FHA loans to finance a primary residence Cons Stricter credit requirements

Fha Loan Requirements For 2022 вђ Complete Guide Blog Hб Ng Conventional, FHA, VA, jumbo loan, physician loan Guild Mortgage has flexible credit requirements, especially for FHA, VA and USDA loans Non-traditional credit sources, like on-time rent Borrowers who have a low credit score or can't afford a large down payment may want to consider an FHA loan Backed by the payment and more lenient credit requirements FHA mortgage rates You can use a conventional loan to purchase a first home, second home or investment property You can only use FHA loans to finance a primary residence Cons Stricter credit requirements

Comments are closed.