Double Entry Accounting And Bookkeeping Principles Explained In Simple

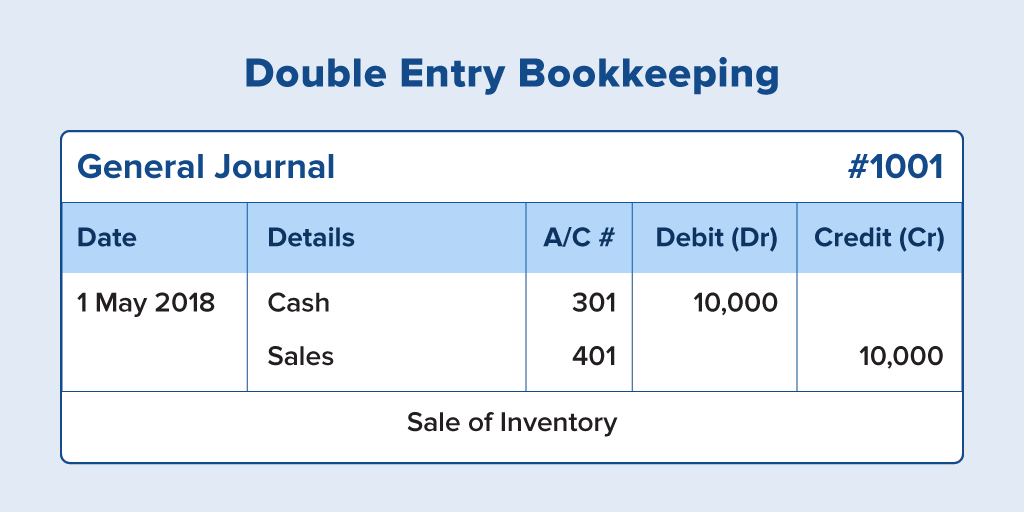

How To Do Double Entry Bookkeeping Slide Course Double entry bookkeeping is an accounting method where each transaction is recorded in 2 or more accounts using debits and credits. a debit is made in at least one account and a credit is made in at least one other account. the total debits and credits must balance (equal each other). for example, a copywriter buys a new laptop computer for her. Double entry is a bookkeeping and accounting method, which states that every financial transaction has equal and opposite effects in at least two different accounts. it is used to satisfy the.

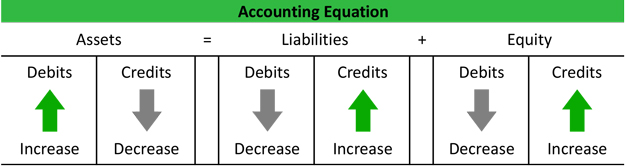

How To Do Double Entry Bookkeeping Slide Course Double entry accounting is a system of bookkeeping where every financial transaction is recorded in at least two accounts. a double entry system provides a check and balance for each transaction, which helps ensure accuracy and prevent fraud. this accounting system also allows you to track business finances more effectively, and make better. Assets = liabilities equity. accountants call this the accounting equation, and it’s the foundation of double entry accounting. if at any point this equation is out of balance, that means the bookkeeper has made a mistake somewhere along the way. in this example, only the assets side of the equation is affected: your assets (cash) decrease. Double entry bookkeeping is the standard method of accounting, and using it provides a number of important benefits: provides a clear view of your company’s financial health. allows you to spot and resolve errors quickly. helps identify profitable and unprofitable aspects of business. To understand how double entry bookkeeping works, let’s go over a simple example to solidify our understanding. assume that alpha company buys $5,000 worth of furniture for its office and pays immediately in cash. in such a case, one of alpha’s asset accounts needs to be increased by $5,000 – most likely furniture or equipment – while.

Comments are closed.