Credit Counseling What Is It And Does It Work Ramsey

Credit Counseling What Is It And Does It Work Ramsey Here’s how it really works: 1. gather all your info. the first thing credit counseling agencies will ask you to do is gather your financial info—all of it. your bank statements, your credit card statements, your mortgage payment info, what you owe (and to whom), and anything else you can think of. they’ll want to wade through every single. 1. debt consolidation. debt consolidation is a type of loan that rolls several unsecured debts into one single bill, usually to get a lower interest rate. the intent is to help you slash mounds of debt. but in reality, you end up staying in debt longer because the term of your loan is extended.

What Is Credit Counselling And How Does It Work Debt Ca Youtube If you’re repaying your debt through a credit counseling program or using a debt management plan, it won’t impact your credit score. but if you end up settling for less than the original amount of the debt, your credit score will almost always take a hit. 1. but here’s the thing: your credit score doesn’t really matter anyway. gasp!. Key takeaways. credit counseling helps consumers with consumer credit, money management, debt management, and budgeting. one purpose of credit counseling is to help a debtor avoid bankruptcy if. Whether you’re trying to rebuild your credit score or you want to tackle debt that has been building up for years, credit counseling provides objective advice and resources to help you get your. Ultimately, dave ramsey’s views on debt consolidation stem from his belief in tackling the root causes of debt and enacting fundamental changes to one’s financial behavior. he emphasizes the importance of living within one’s means, budgeting effectively, and saving for the future as the keys to financial success.

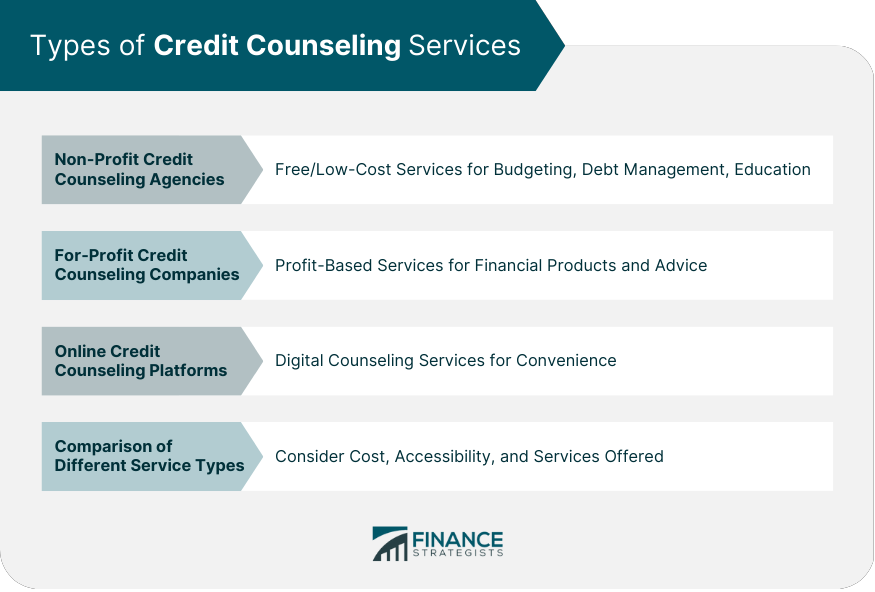

Credit Counseling Meaning Types Process Agency Selection Whether you’re trying to rebuild your credit score or you want to tackle debt that has been building up for years, credit counseling provides objective advice and resources to help you get your. Ultimately, dave ramsey’s views on debt consolidation stem from his belief in tackling the root causes of debt and enacting fundamental changes to one’s financial behavior. he emphasizes the importance of living within one’s means, budgeting effectively, and saving for the future as the keys to financial success. Here’s how debt management plans generally work with consumer credit counseling: you tell your credit counselor about your debts, including balances owed, interest rates and minimum payments;. Under a debt management plan or debt management program, the credit counseling agency works with you and your creditors on a financial plan. you deposit money with the credit counseling organization each month, and the organization uses your deposits to pay your creditors on schedule. but it’s important to note that a debt management plan isn.

Comments are closed.