Credit Counseling Vs Chapter 13

Credit Counseling Vs Chapter 13 Youtube Credit counseling, which allows you to design a workout plan with an expert’s help, is one alternative. bankruptcy is another. if you can’t pay your bills, you need to look at credit counseling and bankruptcy, know the pros and cons of each, then move quickly and choose wisely. anyone who files bankruptcy must undergo credit counseling. A chapter 13 bankruptcy requires people to pay back some or all their debt through a repayment plan. the plan can last either three or five years. some unsecured debt like credit card debt and medical bills can be discharged, meaning they won’t have to be paid. chapter 13 can be a complicated process and it’s strongly recommended that you.

Credit Counseling Vs Chapter 13 Bankruptcy Resolve Here are the steps that typically occur over a chapter 13 bankruptcy: complete credit counseling from an approved agency — within 180 days before filing. hire an attorney to help with preparing the paperwork. compile a list of creditors and how much you owe. provide evidence of a steady income. Must all individuals obtain credit counseling before filing a chapter 7, chapter 11, chapter 12, or chapter 13 bankruptcy? yes. every person who files for bankruptcy must obtain credit counseling, including people with primarily business debts. The agency offering the credit counseling must be approved by the u.s. trustee program office. the session must take place within 180 days before filing for bankruptcy. the counseling fee is about $50, and you can ask for the fee to be waived if you can’t afford it, or to pay it in installments. the credit counseling organization will provide. The session is called “ pre file credit counseling ” and usually costs around $50, but is free if you can’t afford to pay. once you complete the session, you’ll receive a court approved certificate that will allow you to file for bankruptcy. the counseling can be valuable in deciding what sort of bankruptcy petition to file.

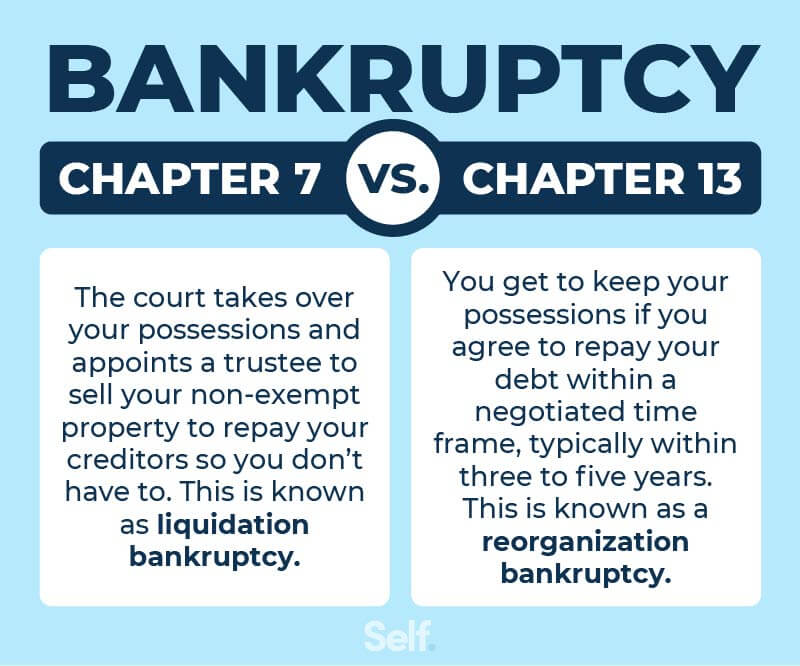

How To Compare Chapter 7 Vs Chapter 13 Bankruptcy 13 Steps The agency offering the credit counseling must be approved by the u.s. trustee program office. the session must take place within 180 days before filing for bankruptcy. the counseling fee is about $50, and you can ask for the fee to be waived if you can’t afford it, or to pay it in installments. the credit counseling organization will provide. The session is called “ pre file credit counseling ” and usually costs around $50, but is free if you can’t afford to pay. once you complete the session, you’ll receive a court approved certificate that will allow you to file for bankruptcy. the counseling can be valuable in deciding what sort of bankruptcy petition to file. A credit counseling agency may be the right choice if you have a steady income and can repay your debt with some assistance. but if your debt is overwhelming and you have difficulty paying or have fallen behind, you may consider chapter 7 or chapter 13 bankruptcy. bankruptcy has two primary forms: liquidation with chapter 7 bankruptcy and. They must also have completed credit counseling to be considered eligible for chapter 13. chapter 13 vs. chapter 7 . chapter 7 is the most common form of bankruptcy, as it allows individuals.

Bankruptcy Dismissal Vs Discharge What S The Difference And How They Affect Credit A credit counseling agency may be the right choice if you have a steady income and can repay your debt with some assistance. but if your debt is overwhelming and you have difficulty paying or have fallen behind, you may consider chapter 7 or chapter 13 bankruptcy. bankruptcy has two primary forms: liquidation with chapter 7 bankruptcy and. They must also have completed credit counseling to be considered eligible for chapter 13. chapter 13 vs. chapter 7 . chapter 7 is the most common form of bankruptcy, as it allows individuals.

Chapter 13 Vs Debt Settlement Which Is The Right Choice For You

Comments are closed.