Conventional Vs Fha Homesmsp Real Estate Minneapolis

Conventional Vs Fha Homesmsp Real Estate Minneapolis For many, it’s a question that can be answered by your income and credit. you need a minimum of 3% down on a conventional loan, 3.5% on fha. your credit score can be lower with fha – as low as 580. if you have had a foreclosure in the last 7 years, you will need to go fha – then you need at least 3 years since the foreclosure. Fha requires an upfront mortgage insurance premium of 1.75% added to your mortgage and a monthly mortgage insurance premium. the monthly mortgage insurance premium just dropped to .55 for those putting 3.5% down. it doesn’t go away until you pay off your mortgage. however, in many cases the fha mi may be less than conventional rates.

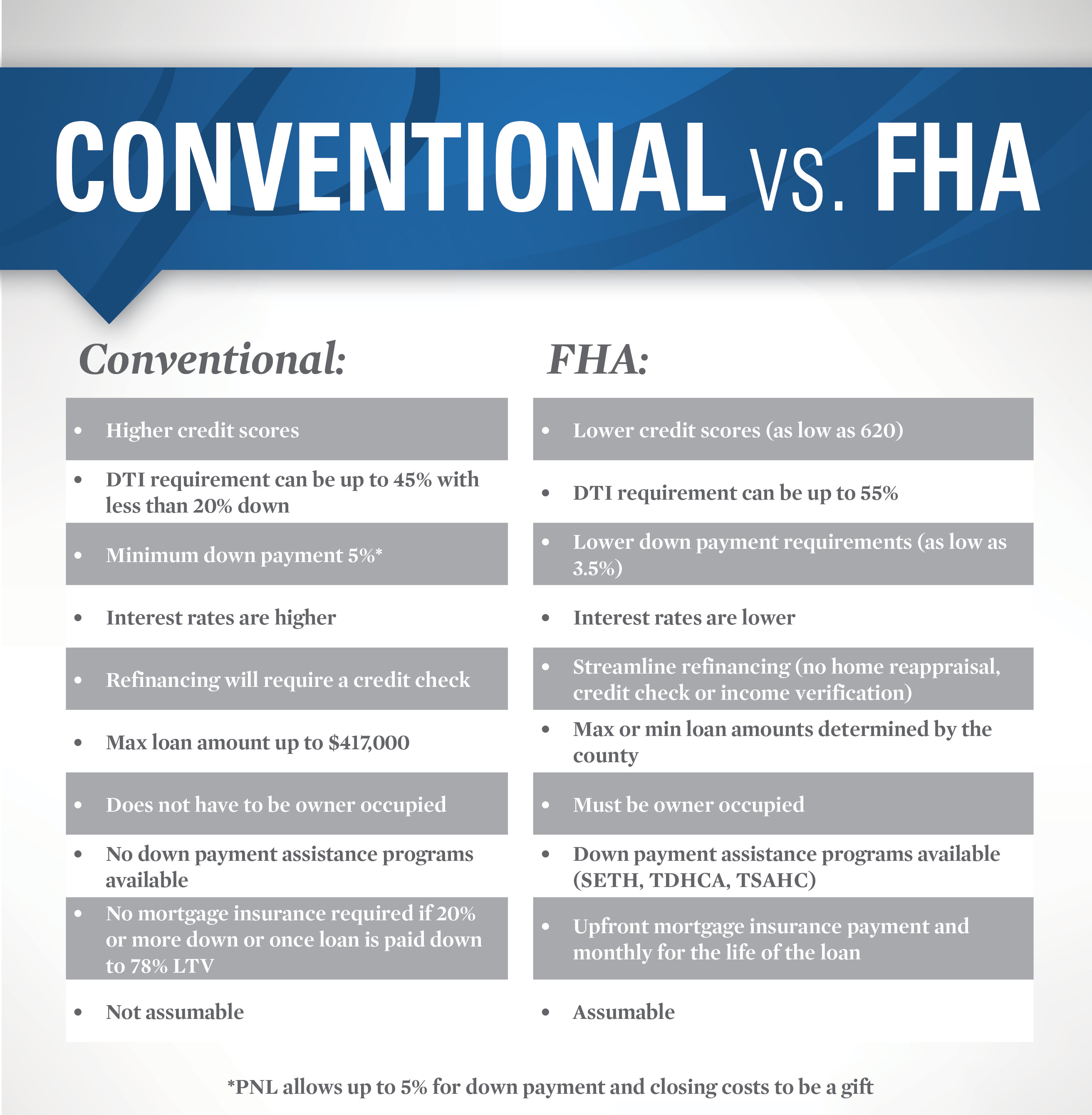

Difference Between Fha And Conventional Mortgage Your Mortgage Guy For Life 🖨 print articleonce you know the difference between the two mortgages, you can decide which is better for you! both are typically fixed rate 30 year mortgages. there are several differences between both loans. fha allows for 3.5% down payment regardless of whether the property is a single family, duplex, 3 4 unit or condo, as […]. Conventional loans usually allow a maximum dti of 43% — meaning your debts take up no more than 43% of your gross monthly income. fha loans allow for a higher dti of up to 50% in some cases. Compare fha and conventional loans to find the best mortgage for you. learn about their pros, cons and differences with nerdwallet. Fha loan interest rates run slightly lower than their conventional counterparts: in mid may, for example, a 30 year fixed fha loan for a $400,000 house was 6.8 percent, vs. 7 percent for a.

Fha Vs Conventional Mortgages Homesmsp Real Estate Minneapoli Compare fha and conventional loans to find the best mortgage for you. learn about their pros, cons and differences with nerdwallet. Fha loan interest rates run slightly lower than their conventional counterparts: in mid may, for example, a 30 year fixed fha loan for a $400,000 house was 6.8 percent, vs. 7 percent for a. Driven by the mission to help more americans become homeowners, fha loans offer a higher loan to value ratio. to put it in simpler terms, fha loans come with lower down payment requirements than conventional loans do. with an fha loan, you can put as little as 3.5% down. the goal of the program is to help put homeownership within reach of more. If your credit score is between 500 and 579, you’ll be asked to make a 10% down payment. here’s an example of how much you’d pay for a down payment on both types of loans: conventional loan down payment of 3% on a $400,000 house: $12,000. fha loan down payment of 3.5% on a $400,000 house: $14,000. fha vs.

Comments are closed.