Consumer Laws How They Apply To The Credit Repair Process

Consumer Laws How They Apply To The Credit Repair Process Youtube Also, through 2026, everyone in the u.s. can get six free credit reports per year by visiting the equifax website or by calling 1 866 349 5191. that’s in addition to the one free equifax report (plus your experian and transunion reports) you get at annualcreditreport . you’re also able to get another free report each year if. To learn more about credit issues and protecting your personal information, visit consumer.ftc.gov. to file a complaint or get free information on consumer issues, visit consumer.ftc.gov or call toll free, 1 877 ftc help (1 877 382 4357); tty: 1 866 . 653 4261.

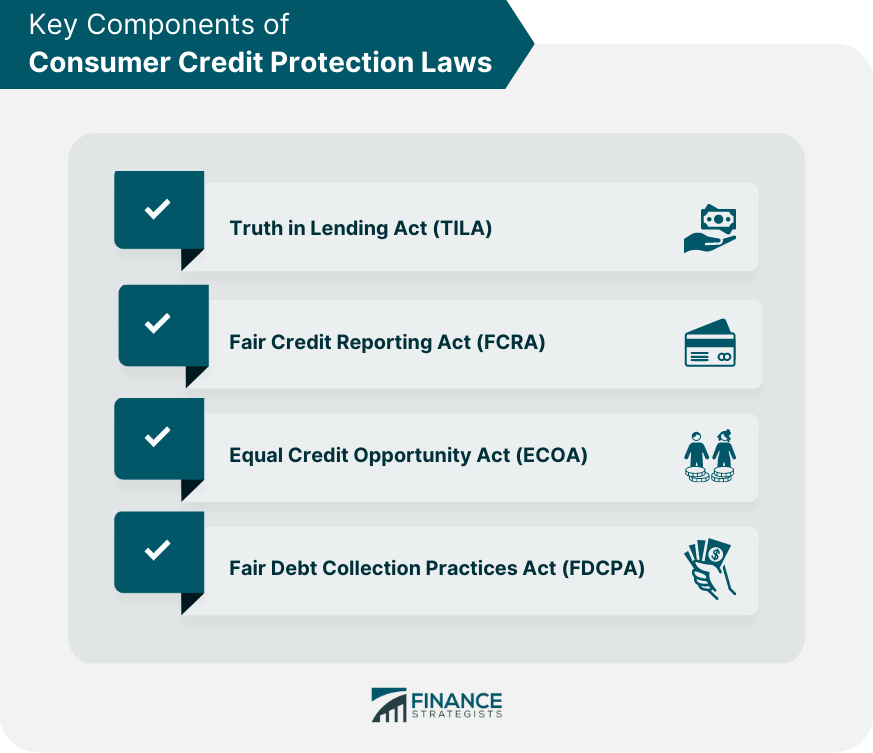

Consumer Credit Protection Laws Meaning History Components Credit repair companies can charge anywhere from $50 to $150 each month and their start up fees can range from $70 to $100. prices largely depend on how much help you need—someone with only one or two errors on their credit report may likely pay less than someone with multiple errors. It’s important to note that credit repair is legal in all 50 states. there’s a federal law that guarantees consumers the right to dispute information in their credit report to have it corrected. there’s also a federal law that outlines how credit repair companies can provide services to consumers. these two laws basically set the. Credit scores range from 300 to 850. a score above 720 is excellent. a score between 620 and 720 is fair to good. the higher your credit score, the more likely you'll be able to borrow money at a lower interest rate. it's important to know your consumer rights under the croa when dealing with credit scores and credit repair services. A state registration requirement. a surety bond to cover potential damages to consumers. a required cancelation period after the consumer signs the contract. a refund period after the consumer signs the contract. here is a list of each state and some specifics about their laws. state. state credit repair laws.

Consumer Credit Protection Act Lexington Law Credit scores range from 300 to 850. a score above 720 is excellent. a score between 620 and 720 is fair to good. the higher your credit score, the more likely you'll be able to borrow money at a lower interest rate. it's important to know your consumer rights under the croa when dealing with credit scores and credit repair services. A state registration requirement. a surety bond to cover potential damages to consumers. a required cancelation period after the consumer signs the contract. a refund period after the consumer signs the contract. here is a list of each state and some specifics about their laws. state. state credit repair laws. The ftc works to prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them. to file a complaint or get free information on consumer issues, visit ftc.gov or call toll free, 1 877 ftc help (1 877 382 4357); tty: 1 866 653 4261. The credit repair organizations act was enacted in 1996 and regulates how a credit repair company must operate under federal law. it protects consumers from receiving untrue or misleading information from credit repair companies and requires certain disclosures in regards to the sale of “credit repair” services.

Comments are closed.