Charts From How Consumers Pay Bills Expectations Vs Reality

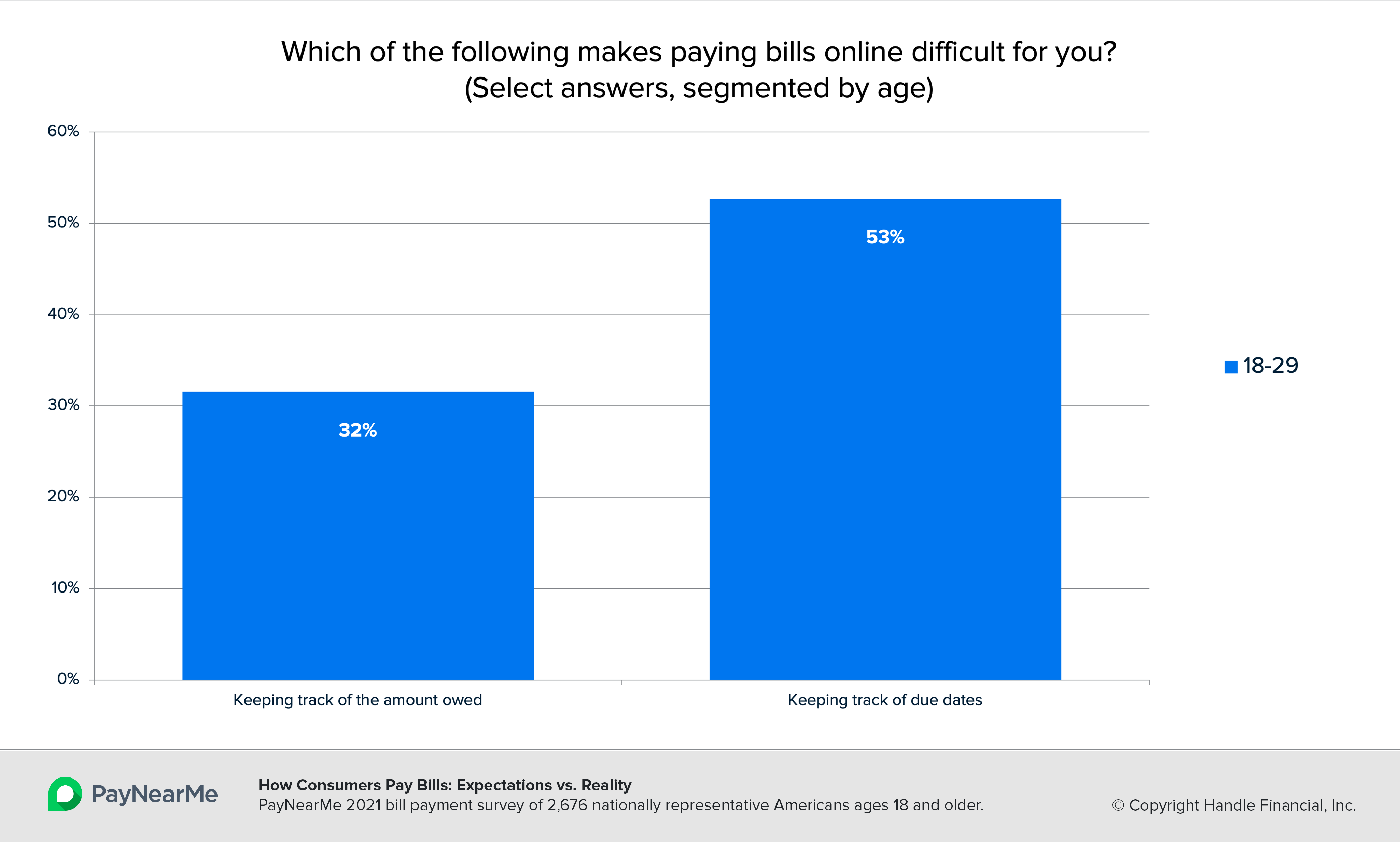

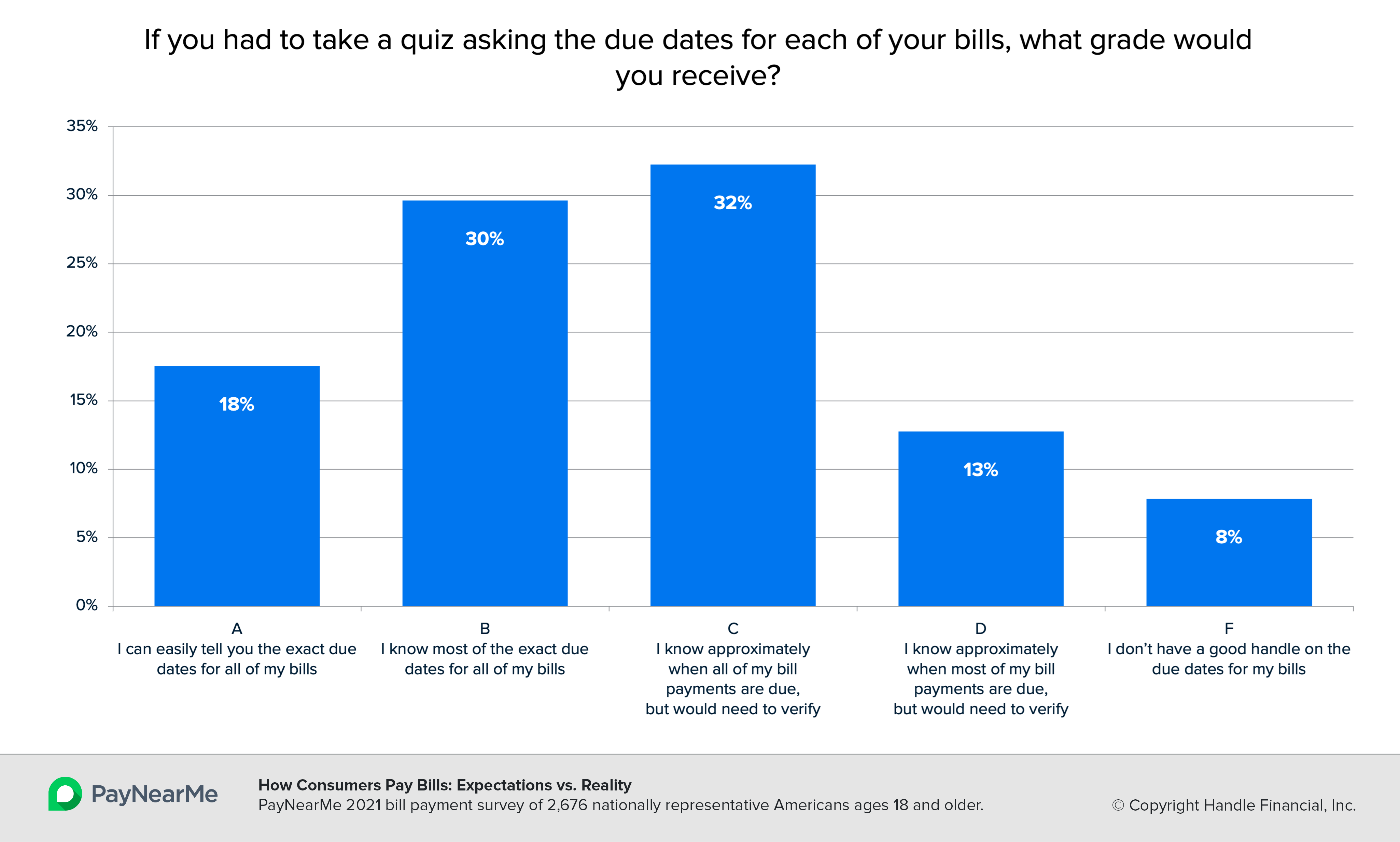

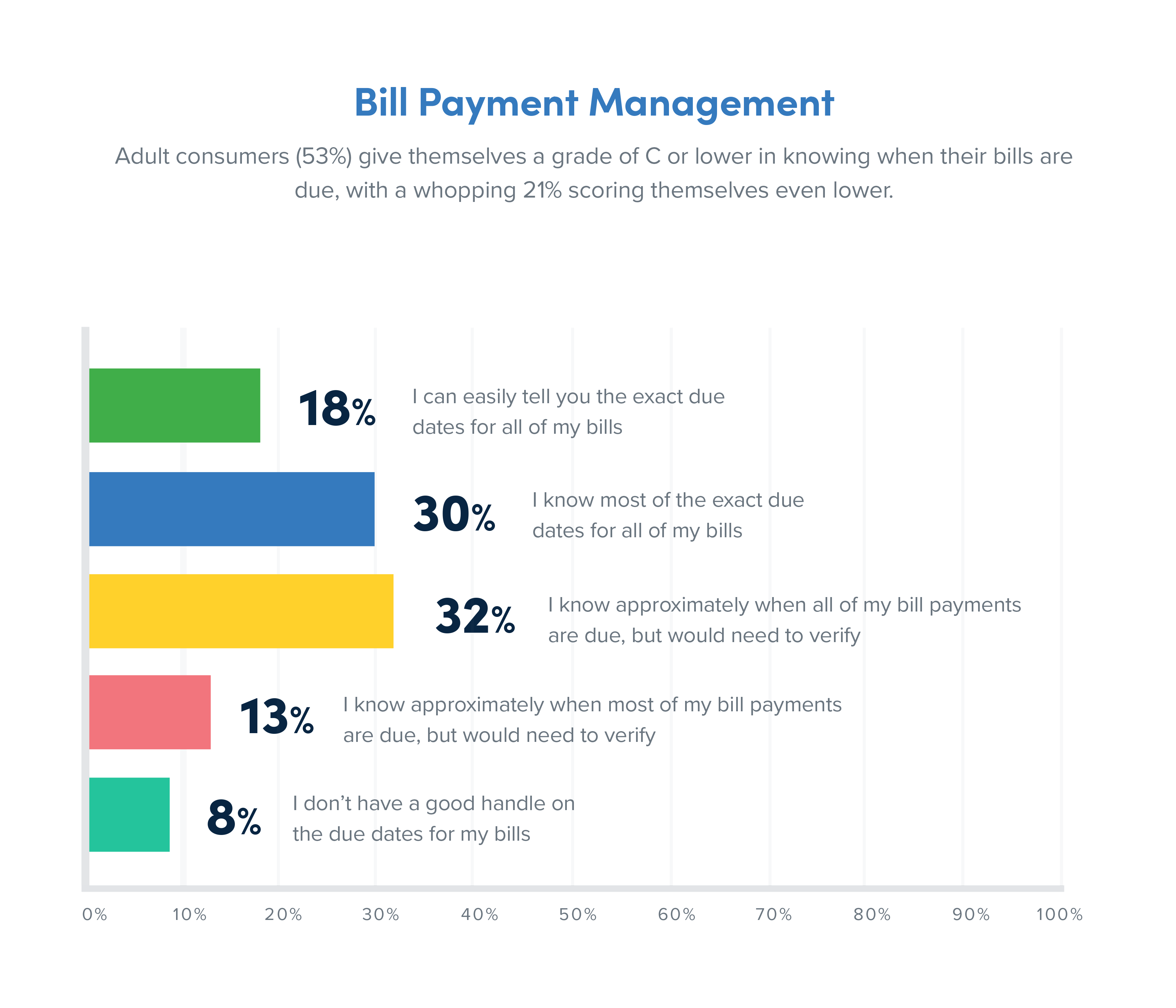

Charts From How Consumers Pay Bills Expectations Vs Reality About this research. paynearme conducted an online survey in april 2021 to determine perceptions and preferences for how u.s. consumers want to pay their bills. what we aimed to learn: how consumers want to pay their bills. what types of features and functionality would make payments easier. what consumers expect from their bill pay experience. Payments industry innovation is changing consumer expectations around bill pay. consumers expect the same fast, convenient and seamless payment experience they have while using p2p payment platforms or making ecommerce purchases from their bill pay experience. nearly half of u.s. consumers polled (48%) feel.

Charts From How Consumers Pay Bills Expectations Vs Reality In early 2021, paynearme conducted a consumer research survey of 2,500 u.s. adults aged 18 across a wide range of demographics to determine their bill pay preferences. the survey aimed to uncover not only how consumers are paying bills today but how they want to pay their bills, what types of features and functionality would make the bill pay. This likely reflects declining expectations for interest rates. fewer mortgage holders—23% in the first quarter of 2024 compared with 31% in the fourth quarter of 2023—expect a major increase in their payments at renewal. they also continue to be confident that they will be able to cope with the increase in payments when they renew their. Santa clara, calif., june 28, 2021 prnewswire prweb paynearme, the modern and reliable payments platform known for making payments easy for both businesses and customers, today released a bill payment study titled, "how consumers pay bills: expectations vs. reality.". Endnotes. 1. the canadian survey of consumer expectations gathers respondents’ views on inflation, the labour market and household finances. the survey for the second quarter of 2021 was conducted from may 4 to may 14, 2021. additional information on the survey and its content is available on the bank of canada website.

Charts From How Consumers Pay Bills Expectations Vs Reality Santa clara, calif., june 28, 2021 prnewswire prweb paynearme, the modern and reliable payments platform known for making payments easy for both businesses and customers, today released a bill payment study titled, "how consumers pay bills: expectations vs. reality.". Endnotes. 1. the canadian survey of consumer expectations gathers respondents’ views on inflation, the labour market and household finances. the survey for the second quarter of 2021 was conducted from may 4 to may 14, 2021. additional information on the survey and its content is available on the bank of canada website. The online survey for the fourth quarter of 2021 was conducted from november 11 to november 24, 2021. follow up telephone interviews were conducted by the market research firm nielsen on behalf of the bank of canada between december 8 and december 16. To compare the attitudes and expectations of consumers with the actions and aspirations of brands, 200 interviews were also conducted with those working for retailers or consumer brands selling direct to consumers online, or via online marketplaces. annual sales revenues of these businesses were more than £10.5 million (or over $15 million).

Charts From How Consumers Pay Bills Expectations Vs Reality The online survey for the fourth quarter of 2021 was conducted from november 11 to november 24, 2021. follow up telephone interviews were conducted by the market research firm nielsen on behalf of the bank of canada between december 8 and december 16. To compare the attitudes and expectations of consumers with the actions and aspirations of brands, 200 interviews were also conducted with those working for retailers or consumer brands selling direct to consumers online, or via online marketplaces. annual sales revenues of these businesses were more than £10.5 million (or over $15 million).

Comments are closed.