Bankruptcy Student Loans Breaking Down The Process

Yes You Can File юааbankruptcyюаб On юааstudentюаб юааloansюаб Hereтащs How The new process will help ensure transparent and consistent expectations for the discharge of student loan debt in bankruptcy; reduce the burden on debtors of pursuing such proceedings; and make it easier for justice department attorneys to identify cases where discharge is appropriate. under the justice department’s new process, debtors will. Data and information tracking the effectiveness of the process over the last year and a half demonstrate that it is achieving its goal of providing a more transparent, equitable, and streamlined mechanism for borrowers to request a discharge of their student loans in consumer bankruptcy cases. the process has translated into increasing numbers.

Bankruptcy Student Loans Breaking Down The Process Youtube So far, “632 cases were filed in the first ten months of the new process (november 2022 through september 2023),” said the education department. this is an impressive number and represents. More student loan borrows have successfully received debt relief through bankruptcy after the biden administration made a policy change to make the process easier nearly two years ago, according. The justice department, in close coordination with the department of education, announced today the continued and growing success of a process instituted in november 2022 for handling cases in which individuals seek to discharge their federal student loans in bankruptcy. data and information tracking the effectiveness of the process over the last year and a half demonstrate that it is. Essentially, this new guidance intends to make it easier to identify cases where bankruptcy for student loans is appropriate. “today’s guidance outlines a better, fairer, more transparent.

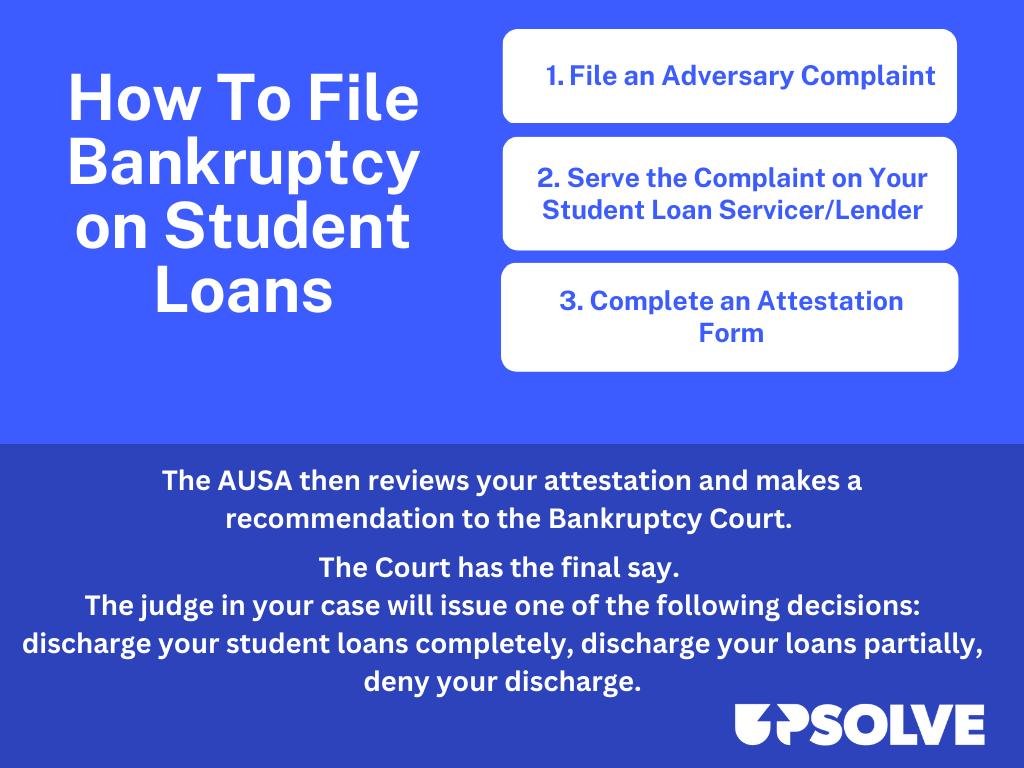

Student Loan Flow Charts Bankruptcy The justice department, in close coordination with the department of education, announced today the continued and growing success of a process instituted in november 2022 for handling cases in which individuals seek to discharge their federal student loans in bankruptcy. data and information tracking the effectiveness of the process over the last year and a half demonstrate that it is. Essentially, this new guidance intends to make it easier to identify cases where bankruptcy for student loans is appropriate. “today’s guidance outlines a better, fairer, more transparent. Borrowers can choose between chapter 7 and chapter 13 bankruptcy, but they must file a separate adversary proceeding for student loans. the new processes established by the department of justice. In the first 10 months since a new bankruptcy process was created last november, 99% of borrowers using it had at least some of their student loan debt discharged, the department of education said.

Can You File Bankruptcy On Student Loans Lexington Law Borrowers can choose between chapter 7 and chapter 13 bankruptcy, but they must file a separate adversary proceeding for student loans. the new processes established by the department of justice. In the first 10 months since a new bankruptcy process was created last november, 99% of borrowers using it had at least some of their student loan debt discharged, the department of education said.

Comments are closed.