Accounting Principles Meaning And Explanations

Accounting Principles Meaning And Explanations The bottom line. accounting principles are rules and guidelines that companies must abide by when reporting financial data. which method a company chooses at the outset—or changes to at a later. In this explanation we begin with brief descriptions of many of the underlying principles, assumptions, concepts, and qualities upon which the complex and detailed accounting standards are based. examples include historical cost, revenue recognition, full disclosure, materiality, and consistency.

Accounting Principles вђ Accrual Matching Full Disclosure Accounting Corner This was the guide to accounting principles and their definition. we discuss the top 6 basic accounting principles with examples and explanations. here are the other articles in accounting that you may like – types of accounting system; ifrs vs indian gaap; accounting vs auditing; accounting tutorial. 10 gaap principles. single entity principle. monetary unit principle. specific time period principle. recognition principle. going concern principle. full disclosure principle. matching principle. principle of materiality. Here’s a list of more than 5 basic accounting principles that make up gaap in the united states. i wrote a short description for each as well as an explanation on how they relate to financial accounting. historical cost principle. revenue recognition principle. matching principle. 10 key principles of gaap. the core of gaap revolves around a list of ten principles. together, these principles are meant to clearly define, standardize and regulate the reporting of a company.

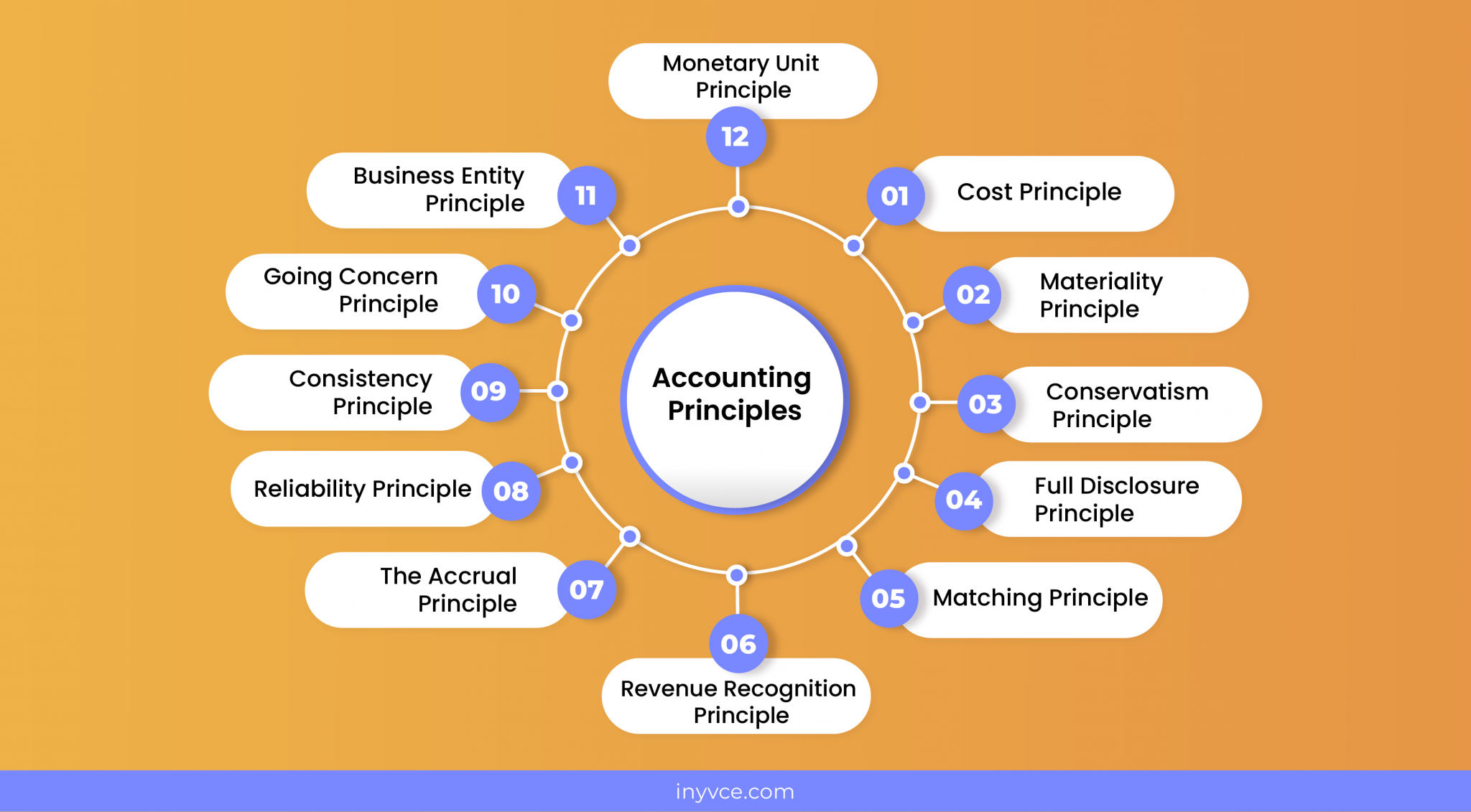

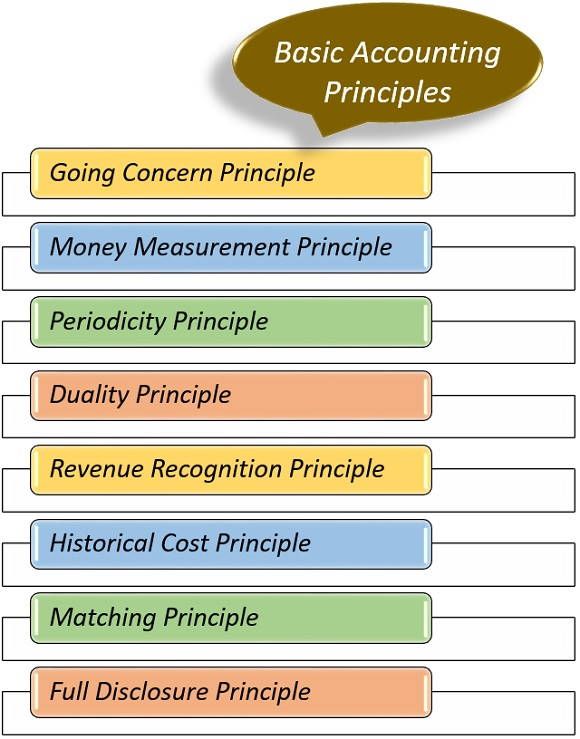

12 Basic Accounting Principles Here’s a list of more than 5 basic accounting principles that make up gaap in the united states. i wrote a short description for each as well as an explanation on how they relate to financial accounting. historical cost principle. revenue recognition principle. matching principle. 10 key principles of gaap. the core of gaap revolves around a list of ten principles. together, these principles are meant to clearly define, standardize and regulate the reporting of a company. Key takeaways. gaap stands for generally accepted accounting principles, which set the standard accounting rules for preparing, presenting, and reporting financial statements in the u.s. the goal. Definition of accounting principles. accounting principles are the common rules that must be followed when preparing financial statements that are distributed to people outside of the company (or other organization). examples of accounting principles. the basic underlying accounting principles, guidelines and assumptions include the following:.

What Are Accounting Principles Definition Gaap And Basic Accounting Principlesо Key takeaways. gaap stands for generally accepted accounting principles, which set the standard accounting rules for preparing, presenting, and reporting financial statements in the u.s. the goal. Definition of accounting principles. accounting principles are the common rules that must be followed when preparing financial statements that are distributed to people outside of the company (or other organization). examples of accounting principles. the basic underlying accounting principles, guidelines and assumptions include the following:.

Comments are closed.