2022 Fha Loans Guide Requirements Rates And Benefits

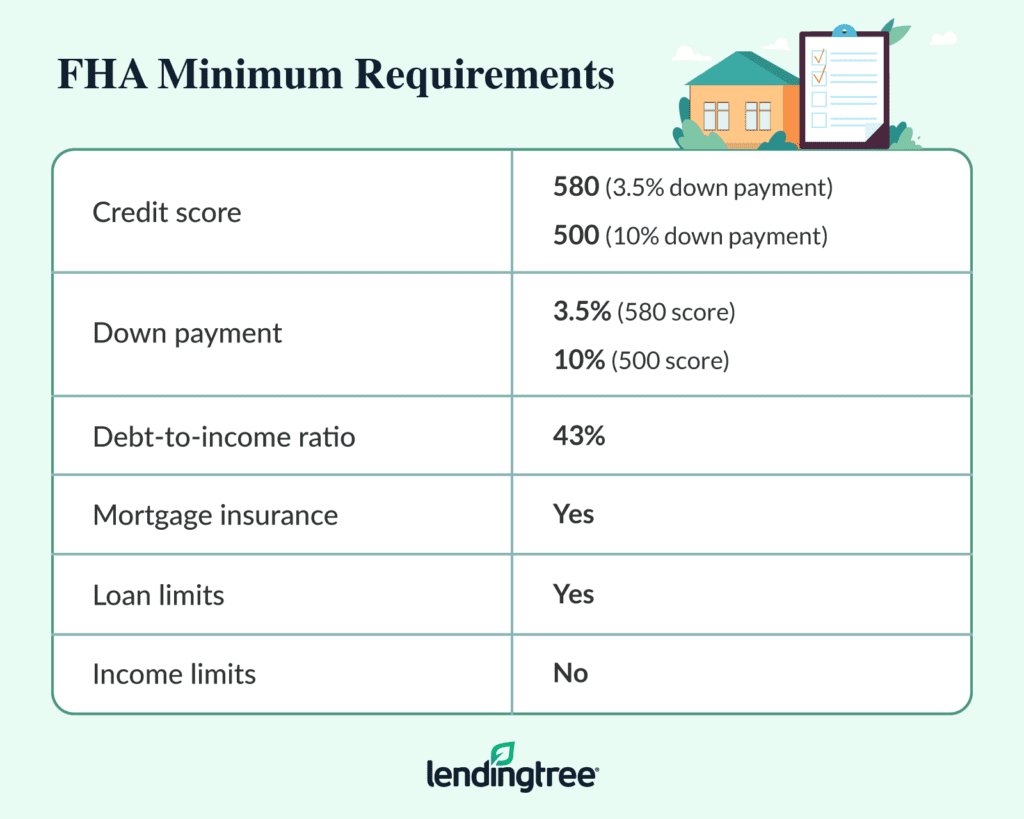

2022 Fha Loans Guide Requirements Rates And Benefits An fha mortgage is ideal for first time home buyers, requiring a minimum credit score of 580 for a 3.5% down payment. those with credit scores between 500 and 579 can still qualify for a 10% down. To qualify for fha loans in missouri, you’ll need to meet the following requirements: a 3.5% down payment if your credit score is 580 or higher. if your credit score is between 500 and 579, you’ll need to put down 10%. a debt to income ratio (dti) of no more than 50%. steady employment history for at least two years.

Fha Loan Requirements 2022 Fairway Independent Mortgage An fha loan requires a minimum 3.5% down payment for credit scores of 580 and higher. if you can make a 10% down payment, your credit score can be in the 500 – 579 range. rocket mortgage® requires a minimum credit score of 580 for fha loans. Fha loan limits change each year and vary depending where you live. in high cost areas, loan limits are higher. “for 2022, fha loan limits for single unit properties range from $420,680 to. With a 30 year fha loan of less than $766,550 and a down payment of 10% of the purchase price, your annual mip premium will be 0.5% of the purchase price. however, if your down payment is less than 5%, you’ll pay a slightly higher rate, 0.55% per year. Fha minimum credit score: 500. fha minimum down payment: 3.5%. fha debt to income ratio: 50% or less. fha loan income requirements. fha loan limits: $498,257 (floor) to $1,149,825 (ceiling) fha.

Comments are closed.