2022 Fha Loan Requirements A Quick Guide For Fha Loans

2022 Fha Loans Guide Requirements Rates And Benefits User quick guide below are some helpful tips for using hud handbook 4000.1, fha single family housing policy handbook (handbook 4000.1): 1. handbook 4000.1 is organized in the sequence of a life cycle of a mortgage. 2. effective dates are shown at the end of heading titles, at the 4th level (e.g., i.a.1.a) in parentheses. 3. Handbook 4000.1 currently has everything a lending entity needs to become fha approved; to originate and receive an fha insurance endorsement; to service; and to adhere to fha's quality control policies for all single family products and programs. two ways to access the handbook 4000.1. stakeholders and the public can access the published.

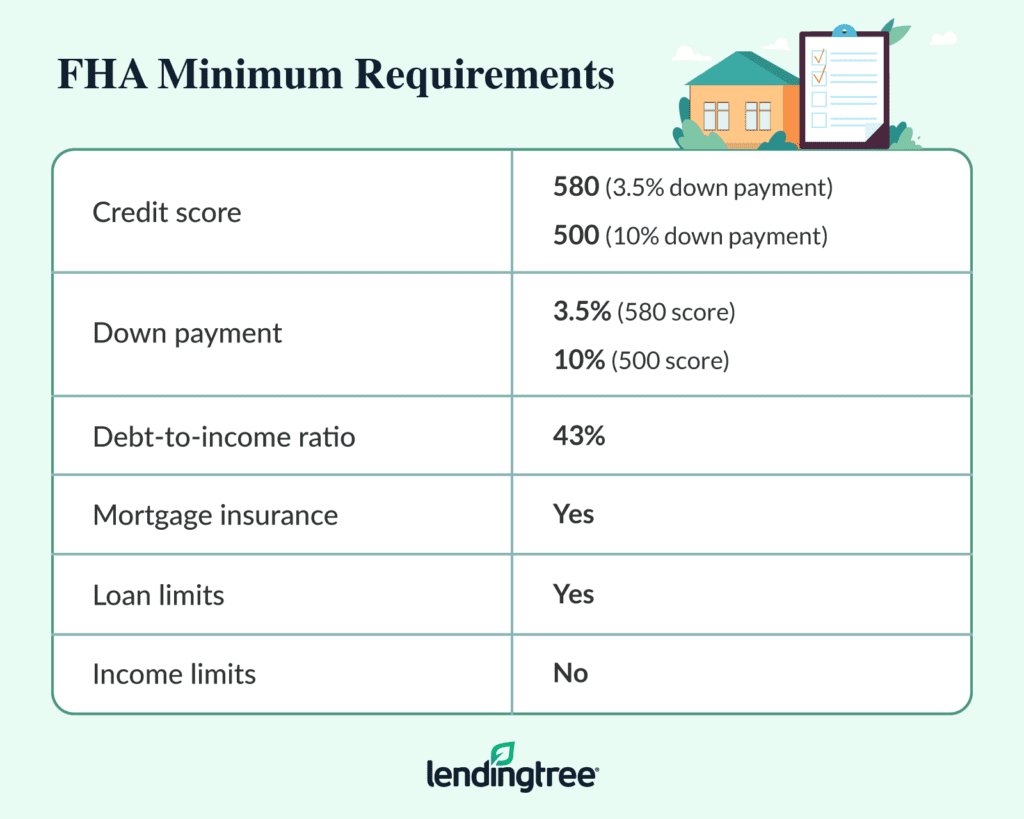

Fha Loan Requirements 2022 Fairway Independent Mortgage Fha loan limits change each year and vary depending where you live. in high cost areas, loan limits are higher. “for 2022, fha loan limits for single unit properties range from $420,680 to. An fha loan requires a minimum 3.5% down payment for credit scores of 580 and higher. if you can make a 10% down payment, your credit score can be in the 500 – 579 range. rocket mortgage® requires a minimum credit score of 580 for fha loans. An fha loan is a type of mortgage that is popular with first time buyers. fha loans are government backed and insured by the federal housing administration. because the program protects the lender if borrowers default on the loan, qualification criteria like credit score and down payment are lower than other loan types such as a conventional loan. Let fha loans help you fha loans have been helping people become homeowners since 1934. how do we do it? the federal housing administration (fha) which is part of hud insures the loan, so your lender can offer you a better deal. low down payments low closing costs easy credit qualifying what does fha have for you? buying your first home? fha might be just what you need. your down payment.

Comments are closed.